Hong Kong’s securities watchdog set out fresh steps on Wednesday to deepen liquidity in its virtual asset market, as the city advances a pro-innovation regulatory approach aimed at embracing new technologies while safeguarding financial stability.

Speaking at Consensus Hong Kong 2026, Julia Leung Fung-yee, CEO of the Securities and Futures Commission of Hong Kong (SFC), unveiled three initiatives designed to expand the scope of crypto products and services.

The SFC will permit brokers to accept virtual assets as collateral for margin financing. Given their high volatility, the arrangement will initially be limited to bitcoin and ether, and subject to the same risk-management standards applied to traditional securities margin lending, including prudent haircuts, Leung said.

According to an SFC statement released on Wednesday afternoon, the move would allow margin clients with strong credit profiles and adequate collateral to participate more actively in virtual asset trading, thus enhancing the liquidity of Hong Kong’s market in a risk-controlled manner.

The regulator has also drawn up a high-level framework enabling licensed trading platforms to offer perpetual contracts, a leveraged instrument that will be open to professional investors in the initial phase.

ALSO READ: Hong Kong-based apparel manufacturer Epic Group explores stake sale

In addition, platforms will be allowed to conduct market-making activities through their functionally independent affiliated units. Participation of these affiliates, the SFC said, should provide licensed virtual asset trading platforms with an additional avenue for liquidity.

Given that crypto platforms combine the roles of exchange and intermediary, Hong Kong has incorporated major requirements from its traditional exchange regime — including client asset protection, no-conflict-of-interest rules and solid financial accounts — into its oversight of digital asset platforms, Leung said. “In that way, we provide certainty and clarity.”

Eric Yip Chee-hang, executive director of the SFC’s intermediaries division, said “Liquidity does not emerge organically; it must be cultivated through openness, strong governance, and a purposeful regulatory design.”

Through targeted access reforms, product expansion, and structured innovation support, Hong Kong is well positioned to become a leading global digital assets center, where liquidity is underpinned by integrity, resilience, and international cooperation, he added.

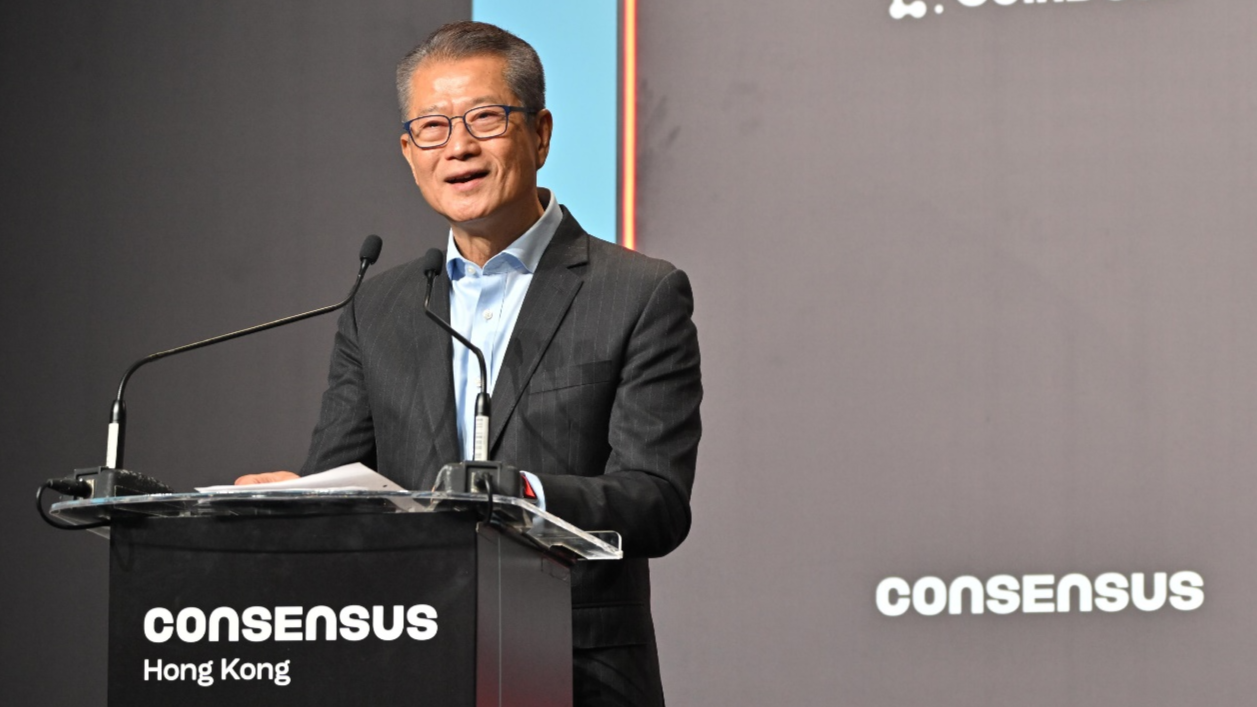

In a keynote address during the crypto and blockchain conference, Financial Secretary Paul Chan Mo-po said the city is finalizing the details of a new licensing regime for digital asset dealers and custodian service providers, with legislation expected to be introduced this summer.

Together with the frameworks already in place, Chan said “this will ensure that Hong Kong’s overall regulatory regime comprehensively covers the key nodes of the digital asset ecosystem”.

“Innovation often moves faster than regulation, potentially creating gaps and new risks,” he said, adding that policymakers are striving to balance innovation with robust risk management.

Hong Kong launched a regulatory framework for stablecoin issuers in August and plans to grant a small number of licenses in the first batch in March.

Chan described stablecoin as a practical tool capable of addressing real-economy frictions, particularly in payments and settlement. Applicants, he said, need to demonstrate that they have “real-world use cases, a credible and sustainable business model, as well as strong regulatory compliance capabilities”.