European companies are shaking off some of the uncertainty that dominated most of 2025 and turning their attention to what looks to be a much brighter year ahead.

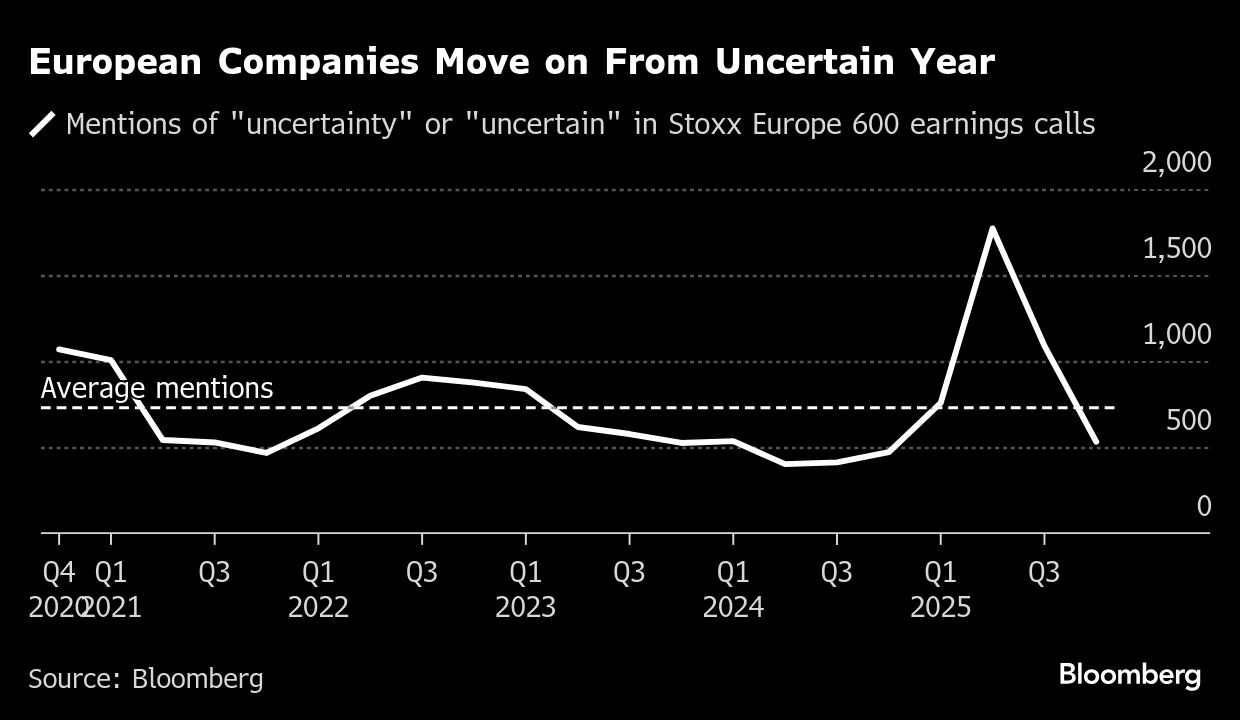

Mentions of “uncertainty” on European companies’ earnings calls slipped below the five-year average over the course of the third-quarter earnings season, and is at the lowest this year after peaking over the second quarter, a Bloomberg review of transcripts shows.

European firms largely defied gloomy earnings expectations for the third quarter, with more guidance upgrades than cuts. They also weathered tariffs and currency fluctuations to post stronger-than-expected margins.

This coincided with clearer trade policies that allowed companies to be more confident in their cost and earnings trajectory going forward.

Trade clarity

References to tariffs in earnings calls also dropped from the first and second quarters, according to a Bloomberg Intelligence analysis of transcripts. “The overall tone has turned more positive, with discussions around supply chains, inflation and recovery increasingly upbeat,” BI strategists Kaidi Meng and Laurent Douillet wrote in a note.

Over the summer, the US and the European Union struck a trade deal for a 15 percent tariff rate, while firms like Merck KGaA have also negotiated company-specific agreements with the US administration. Switzerland, the developed economy hit with the highest tariffs, has just managed to reach a preliminary deal with Donald Trump to lower the punitive rate of 39 percent to 15 percent.

Some sectors are still struggling under the weight of trade tensions. Hexpol AB, a manufacturer of rubber and plastic components for the automotive and construction industries, had the highest mentions of uncertainty of the entire Stoxx 600 Europe Index.

ALSO READ: European firms pause sales to US over tariff-related rules

“High uncertainty continues, triggered by US tariffs and US trade policy and that is impacting us indirectly,” Chief Executive Officer Klas Dahlberg said on the earnings call, explaining that levies had hurt customers in North America and held back demand.

Swedish truck-maker Volvo AB, whose earnings call was also replete with mentions of uncertainty, expects weakness in North America to last into next year as orders dwindle because of reduced freight activity and 25 percent tariffs on medium and heavy-duty trucks that took effect earlier this month.

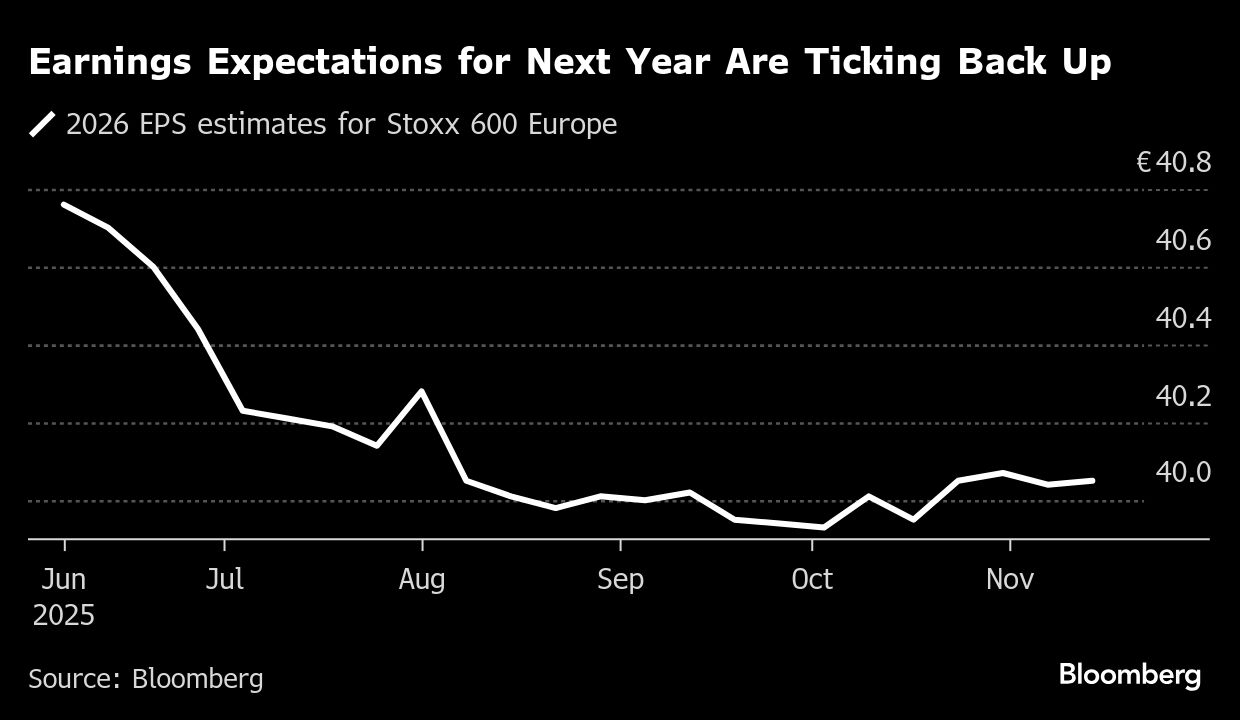

Weakness is now concentrated, rather than across the board, boosting confidence in a recovery next year. This has in turn triggered positive estimate revisions for 2026, with expectations ticking back up since the beginning of the third-quarter earnings season.

Although some sectors like autos and chemicals are still in a tough spot, “the broad-based margin resilience across cyclical and defensive industries provides a stronger earnings foundation heading into 2026,” Meng and Douillet said.