Chuangxin Industries Holdings Ltd, a Chinese mainland aluminum smelter, is planning for its initial public offering in the Hong Kong Special Administrative Region to fetch about $700 million, according to people familiar with the matter.

The company, based in the Inner Mongolia autonomous region, plans to start taking investor orders as soon as Friday for a listing in the coming weeks, the people said, asking not to be named discussing private information. It started gauging investor interest this week, according to terms of the deal seen by Bloomberg News.

ALSO READ: HKEX sees record surge in listing applications

Deliberations are ongoing, so the size and timing of the deal may change, the people said. Chuangxin didn’t immediately respond to a request for comment.

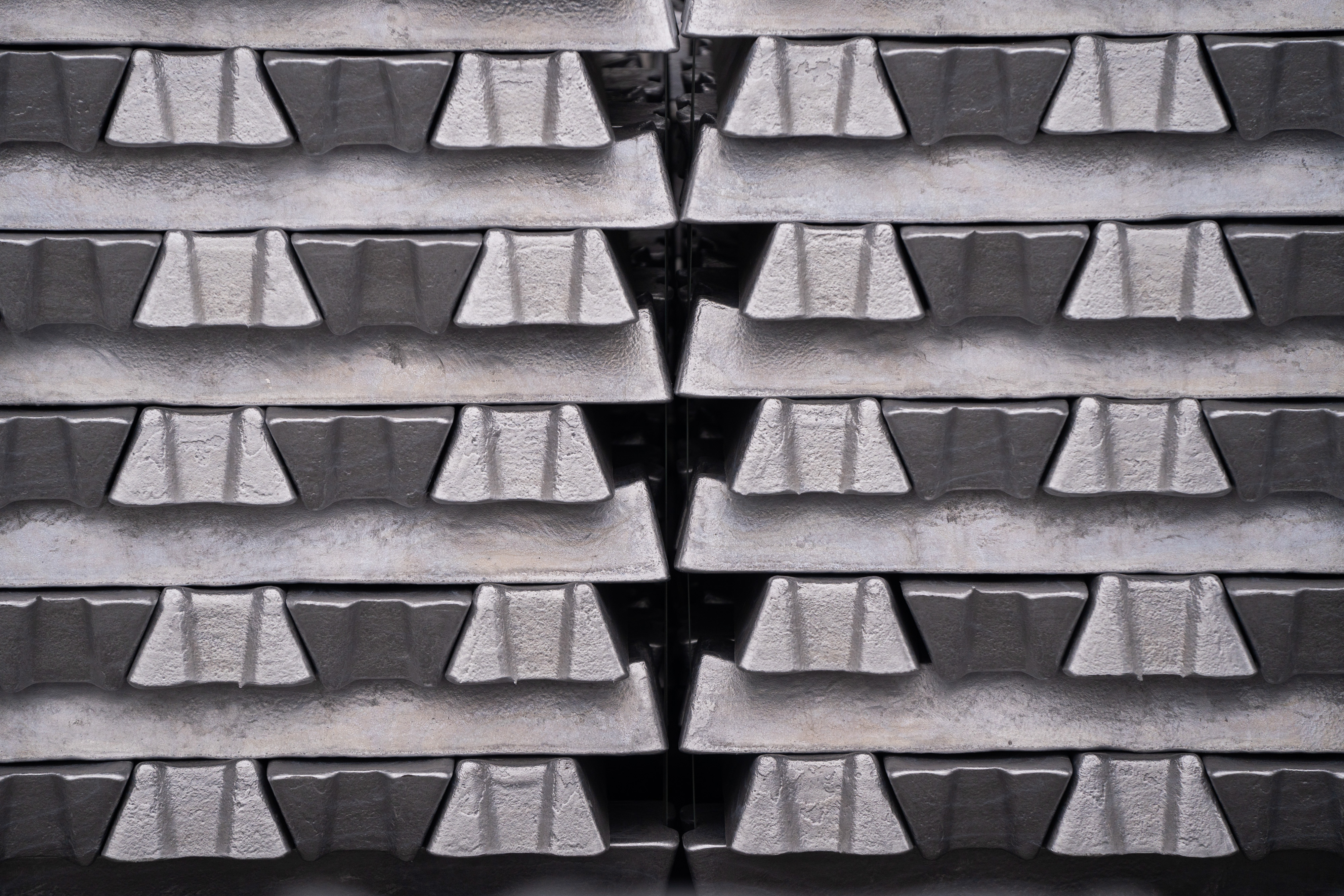

Mainland aluminum smelters, producing half of the world’s primary aluminum, are enjoying elevated profitability helped by resilient mainland demand buoyed by the renewable energy sector. Aluminum has also been one of the strongest performers on the London Metal Exchange in recent months, reaching a three-year high last week.

READ MORE: Chan: HK reigns as global IPO leader with $19b raised

Chuangxin counts on the production of primary aluminum and alumina for much of its business. Its biggest customer is Shanghai-listed Innovation New Material Technology Co, which is headed by Chuangxin’s chairman, Cui Lixin, according to a filing with the Hong Kong stock exchange.

China International Capital Corp and Huatai Securities Co are arranging Chuangxin’s IPO.