The frenzy over artificial intelligence has helped Asian stocks outperform the world this year. It’s also transforming the region’s markets in a way that has fund managers racing to keep up.

Fears of concentration in the US have been well documented, as the six largest tech stocks now account for more than 30 percent of the S&P 500 Index. The concern is the potential impact should there be any rapid unwind of a rally that has seen Nvidia Corp’s market cap soar to $5 trillion from $1 trillion in just two years.

The risks in some Asian markets are even more pronounced, with Taiwan Semiconductor Manufacturing Co alone approaching a weighting of 45 percent in its benchmark Taiex, three times its level a decade ago. South Korea’s Kospi has become a duopoly, with memory-chip giants Samsung Electronics Co and SK Hynix Co making up a combined 30 percent.

The dominance of tech stocks in Asian benchmarks is upending traditional portfolio strategies. Index trackers face pressure to increase tech exposure just to keep pace, while funds with single-stock limits struggle to match returns in gauges overwhelmingly driven by a handful of chipmakers and internet firms.

“Concentration has blurred the line between passive and active trading, as fund flows increasingly cluster around the same few names,” said Hebe Chen, an analyst at Vantage Markets in Melbourne. “With fewer avenues for diversified participation, any pause in AI momentum could trigger outsized corrections across the region.”

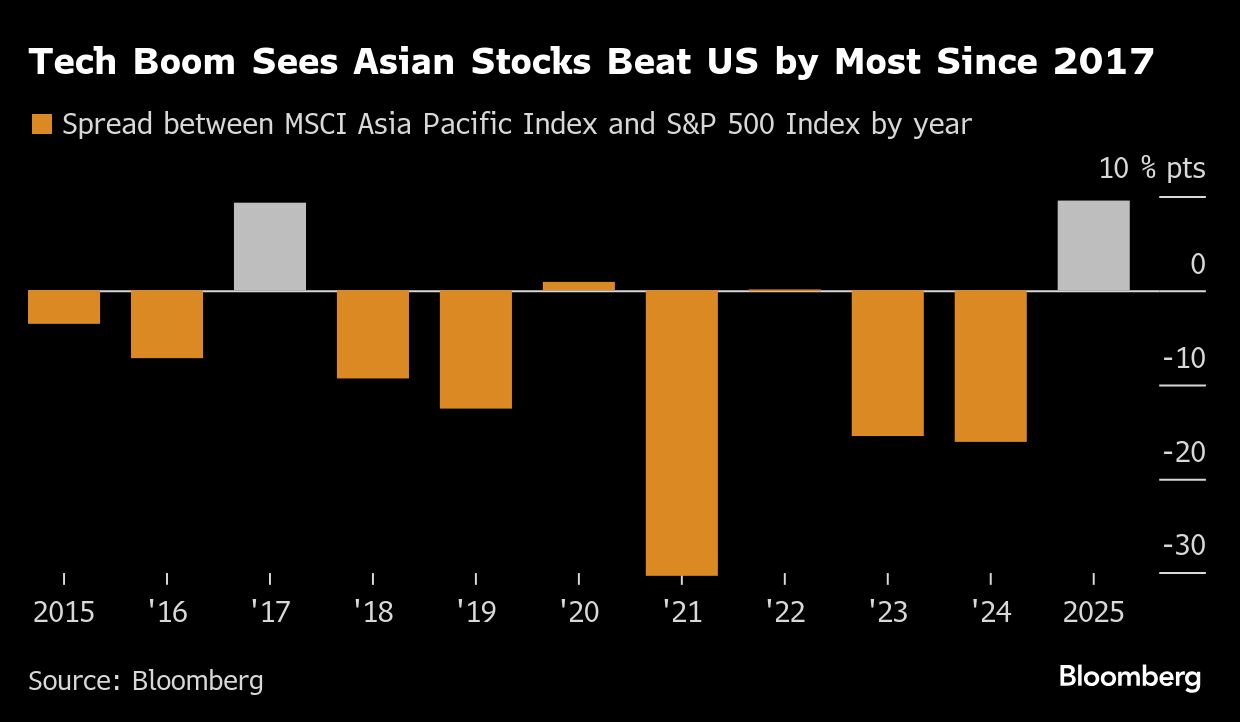

Asia’s chipmakers have seen their market values soar, with TSMC crossing the $1 trillion mark in July. Investors chasing beneficiaries of the tidal wave of hyperscaler spending on AI have pushed the MSCI Asia Pacific Index up 26 percent this year, on track to beat the S&P 500 by the most in eight years.

Vicious cycle

The latest earnings reports from the region’s major players in the AI supply chain have fueled optimism in the long-term demand trend. Extended surges in stocks on such news indicate that concentration is likely to snowball.

“The high and growing weight of tech stocks in indexes is an issue because benchmarked investors have to increase their allocation into a very small concentrated list of stocks, which in turn drives their prices and index weights even higher,” said Vey-Sern Ling, senior equity adviser for Asia technology at Union Bancaire Privee. “It’s a vicious cycle which inflates valuations of ‘hot’ stocks.”

The problems can be acute for those with mandates to invest in specific markets.

ALSO READ: Tech leaders boost AI spending, but Alphabet's cash flow wins investor favor

Even markets less tech-dominated have been impacted. Japan’s top AI plays Advantest Corp and SoftBank Group Corp have climbed to become the heftiest stocks in the price-weighted Nikkei 225 at more than 10 percent each — a level that could force trimming under the compiler’s rules. Components maker Delta Electronics (Thailand) Pcl ran into bourse-imposed 10 percent caps on key gauges earlier this year.

Broader regional trading has become challenging also. The top five stocks in the MSCI Asia Pacific Ex-Japan Index now have a total weight of 29 percent, near the highest since 2019, according to Citigroup Inc Alibaba Group Holding Ltd. and Tencent Holdings Ltd. are among those with the highest long-crowding scores, along with TSMC, analysts including Yue Hin Pong wrote in a note this month.

Tech dominance in the MSCI Emerging Markets Index is even more extreme, with the gauge more concentrated than it’s been in 20 years, Bloomberg Intelligence analysts including Kumar Gautam wrote in a note Friday.

Some index providers have moved to help investors navigate the problems. FTSE Russell has capped weightings in some indexes, while MSCI and S&P Global have begun providing alternative capped versions of key gauges.

Constrained ability

For active funds governed by European rules, a 10 percent limit on single-stock exposure is a major hurdle. TSMC’s share of the MSCI Asia Pacific Ex-Japan crossed that threshold last year and has climbed to over 12 percent.

“We have a long-term conviction in TSMC, and now the 10 percent limit constrains our ability to maintain that full overweight,” said Jian Shi Cortesi, a fund manager at GAM Investment Management in Zurich.

Other investors seeking substitutes for Asia’s largest stock prefer options more directly related.

For accounts with 10 percent restrictions, “we tend to want to find stocks as close to TSMC in the value chain as possible,” such as ASE Technology Holding Co, Hon Hai Precision Industry Co, Chroma ATE Inc and Globalwafers Co, said Xin-Yao Ng, a fund manager at Aberdeen Investments.

Multi-year theme

While the changed landscape has made fund managers’ jobs more difficult, the stock gains have been large in absolute terms. TSMC is up 40 percent year to date while SK Hynix has soared more than 220 percent. Plans by the likes of Meta Platforms Inc and Amazon.com Inc to keep pouring out cash for tech hardware may keep fueling the rally.

“Equity investors we’ve spoken to generally view AI as a multi-year theme, despite the potential for short-term pullbacks,” said Winnie Wu, head of Asia Pacific equity strategy at Bank of America.

She pointed out that markets in China, Japan and India are more diversified so they should be relatively less impacted by volatility in AI or the tech cycle.

READ MORE: Meta to raise $30b in its biggest bond sale as AI expansion costs rack up

China in particular offers “diversification benefits, and can serve as a hedge against US equity and AI cycle-related risks”, Wu said.