US Treasury Secretary Scott Bessent and Japanese Finance Minister Katsunobu Kato reaffirmed in a joint statement their basic commitment to let markets determine currency exchange rates and not to target them for a competitive advantage.

“They reconfirmed their recognition of the G7 commitment that fiscal and monetary policies will remain oriented towards meeting respective domestic objectives using domestic instruments and will not target exchange rates for competitive purposes,” according to the statement detailing talks between the two finance chiefs.

The two chiefs still left scope for intervention in certain circumstances in line with previous statements, saying that it should be reserved for dealing with excess volatility or disorderly movements in the currency market. The release added that the two chiefs will continue to discuss macroeconomic and currency matters going forward.

The statement comes roughly a week after US President Donald Trump signed an executive order putting into effect the two nations’ recent trade deal. The statement indicates that the two countries intend to keep currency matters separate from Trump’s potential push to reduce the US trade deficit in the future.

READ MORE: Japan finance minister says he will closely communicate with US on forex

The remarks also serve as a reminder that the Trump administration is keeping a close eye on Japanese policy and currency movements. Trump has repeatedly commented on the yen’s weakness in the past, saying in March that Japan puts the US at a disadvantage when its currency weakens.

The latest statement from the finance chiefs went into more detail than usual on what might be considered tools for manipulating the currency, but didn’t state a need for any change in Japanese policy.

The yen edged a tad weaker against the dollar, following the release.

“I believe it was very meaningful that we were able to clearly confirm these points this time,” Kato told reporters Friday in Tokyo. “In the joint statement, the US and Japan reaffirmed the importance of a transparent foreign exchange policy, along with the shared understanding on FX policy up to now.”

The statement specified that macroprudential steps, measures on capital flows and government investment vehicles including pension funds should also not be used to target currency levels for competitive objectives, details that showed the close watch the US is keeping on policy.

Japan remains on the currency policy monitoring list in the Treasury’s most recent report issued in June. While Japan didn’t cross the US threshold for currency intervention in the latest report, the size of its current account surplus and its trade surplus with the US did meet criteria for close monitoring.

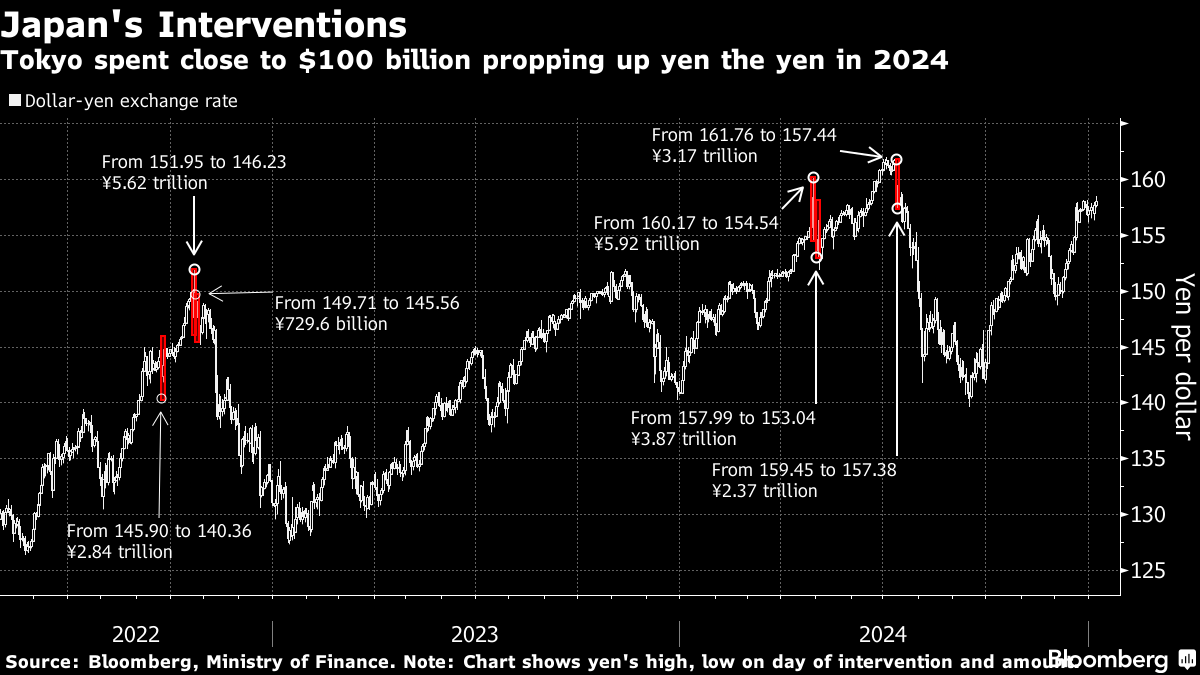

Tokyo has spent close to $150 billion in the last three years trying to prop up the yen with the last move in July last year. Japan’s interest rates, even after multiple hikes, still remain far below international levels, a factor that has dragged on the currency.

READ MORE: Japan sees little scope for grand deal on yen in talks with US

While the statement said intervention is considered equally appropriate in case of currency appreciation or depreciation, moves that strengthen a currency are typically seen as less problematic by international trading partners, since they can make Japan’s exports more expensive and less competitive.

Kato told reporters that the latest joint release will not impact how Japan conducts any currency intervention going forward.

Beyond the latest wording on interventions, investors are also watching for any indication that the US favors a stronger Japanese currency.

In August, Bessent said the Bank of Japan was falling behind the curve in addressing inflation and that he expected the bank to raise interest rates again, a comment that some observers saw as an indication he might also be looking for a stronger yen.

The BOJ meets next week and is widely expected to keep interest rates unchanged amid political instability, with the nation’s ruling party getting ready to choose a new leader following the resignation announcement of prime minister Shigeru Ishiba.

Still, the central bank has made clear it will continue to raise rates if the economy develops as expected, leaving investors trying to gauge how soon the next move might come. Expected US rate cuts are likely to narrow the difference between the two countries’ borrowing costs, helping support the yen over the coming months.

“There may be an implicit message from the US side that instead of using FX intervention to stop the yen’s depreciation, the BOJ should respond by raising interest rates,” said Eiichiro Miura, a senior general manager of investments of the strategic investment department at Nissay Asset Management.