Bitcoin hit a record high Wednesday, moving in lockstep with a rally in US equities as investors pushed deeper into risk-taking territory across world markets.

The cryptocurrency rose past $123,500 on Wednesday evening in New York, topping the previous all-time high of $123,205.12 reached on July 14. The original crypto token was trading at $124,000 in Singapore at 8:38 am Thursday. The milestone came soon after the S&P 500 closed at its own record for a second consecutive session, extending a summer run that has carried the benchmark to repeated highs.

Bitcoin has been steadily rising for most of the past year as a result of the friendly legislative climate in Washington ushered in by President Donald Trump. Public companies, led by Michael Saylor’s Strategy, have boosted the demand by following an increasingly popular corporate tactic of stockpiling the original cryptocurrency. The playbook has recently spread to smaller competitors, like Ether, leading to a broad rise across digital assets.

Bitcoin’s market cap rose to around $2.5 trillion and Ether’s to nearly $575 billion, with both tokens holding about 70 percent of all crypto traded, according to CoinGecko.

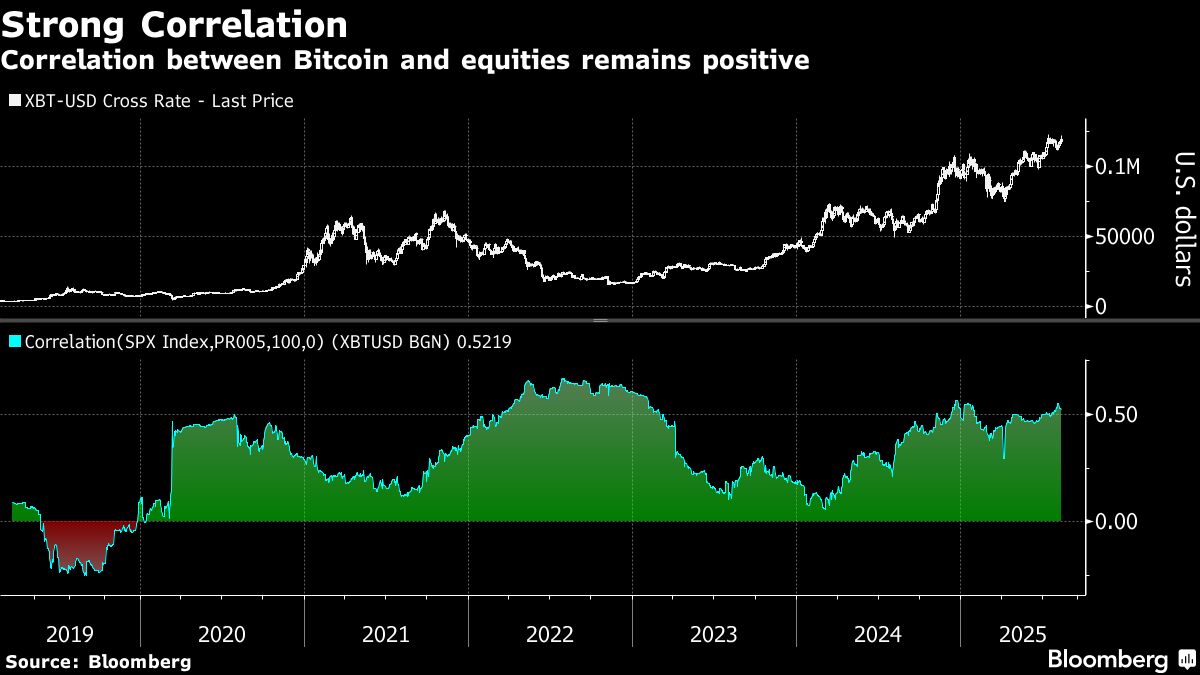

The coordinated move underscores how speculative market corners and mainstream benchmarks are drawing from the same well of optimism. US inflation data landed in line with expectations this week — and strengthened bets the Federal Reserve will cut interest rates in September, easing financial conditions and encouraging capital to flow from blue-chip equities to volatile digital tokens.

“Crypto has been positively correlated to equities with the relationship stronger for ETH than BTC,” said Chris Newhouse, director of research at Ergonia. “General sentiment looks positive.”

Ether’s rise has been propelled by sustained demand from newly active treasury firms, while Bitcoin’s steadier climb has leaned on persistent exchange-traded inflows even as it has faced technical resistance.

READ MORE: Bitcoin flirts with $100,000 level as angst over Fed path eases

“The combination of moderating inflation, growing expectations for rate cuts, and unprecedented institutional participation through ETFs has created a powerful tailwind,” said Ben Kurland, CEO at crypto research platform DYOR. “What’s different this time is the maturity of the demand base — this rally isn’t just retail euphoria, it’s structural buying from asset managers, corporates and sovereigns.”