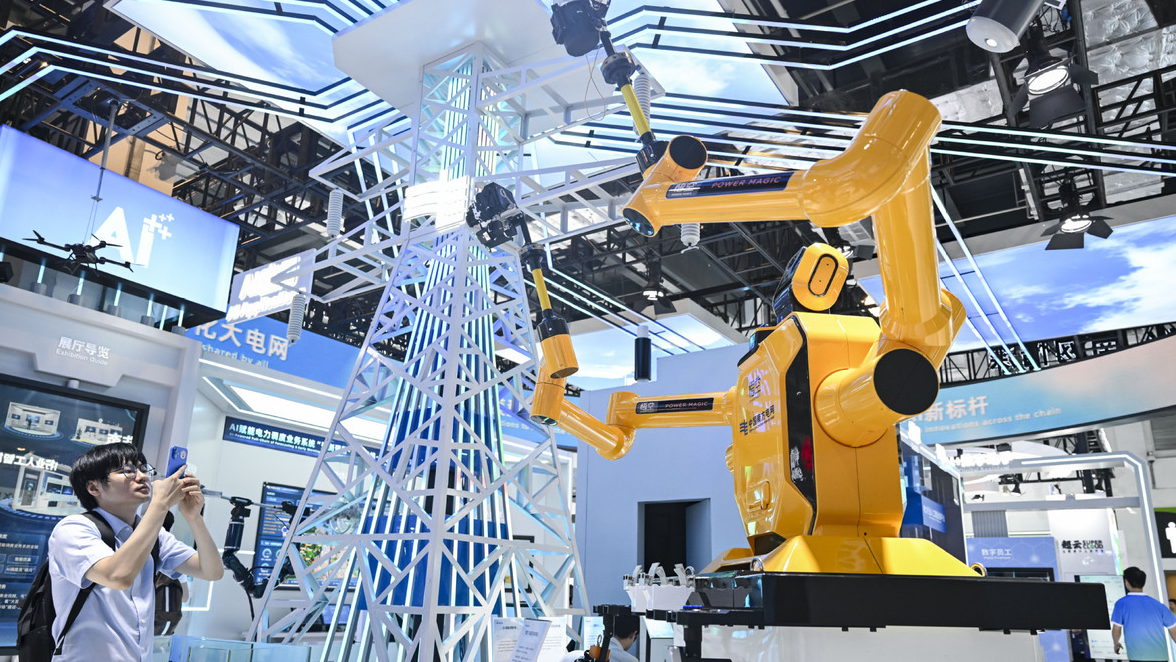

China is emerging as the world's leading force in robotics, combining artificial intelligence with smart manufacturing strength to dominate both production and installation, according to recent industry analyses.

While the United States, Germany, and Japan have historically led in robotics technology, China is now outpacing its peers in terms of output, deployment, and domestic adoption.

"China is emerging as a robotics powerhouse as it combines advanced artificial intelligence with low-cost manufacturing to fill industries with smart and affordable robots," said a new report by Moody's Ratings.

The nation's robust growth in the robotics sector is fueled by rapid advances in supporting technologies, including 5G networks, semiconductors, sensors, and battery innovation. These advances are driving not only the development of traditional industrial robots but also a new generation of AI-powered humanoids.

Market expansion

In absolute terms, China has installed more than half of the world's robots since 2021, averaging around 280,000 new units annually, according to the Moody's report shared with China Daily.

The country's robot density — the number of robots per 10,000 employees — climbed from 97 in 2017 to 470 in 2023, a nearly fourfold increase. This places China second globally, next to South Korea (1,012) and ahead of Germany (429), Japan (419), and the United States (295), according to Moody's.

A separate report from Morgan Stanley projects that China's robotics market will more than double from $47 billion in 2024 to $108 billion by 2028, expanding at an annual rate of 23 percent. China already accounts for about 40 percent of the global robotics market, underscoring its rising stature as an innovation hub.

Analysts attribute much of the recent boom to China's shift toward emerging high-tech industries such as new energy vehicles, solar panels, and lithium-ion batteries — sectors that are increasingly relying on domestically produced, cost-effective robotics to meet production demands.

Data cited by Moody's shows that lithium-ion battery production in China reached 29 billion units in 2024, a 20 percent year-on-year increase. Solar panel output hit 685 gigawatts, up 27 percent over the previous year, while new energy vehicle production rose 34 percent to 12.9 million units in 2024.

ALSO READ: China tops global AI model count, over 1,500 large models released

Industrial dominance

China has maintained its position as the world's largest market for industrial robots for over a decade, with widespread adoption across the automotive, electronics, and metal processing industries.

According to market research firm Grand View Research, China's industrial robotics market is projected to reach $16.5 billion by 2033, growing at a compound annual growth rate of 6.1 percent from 2025 onward.

Rising labor costs and an aging workforce are pushing companies to invest more heavily in automation across key manufacturing industries such as electronics and automotive.

Additionally, the rising shift towards smart manufacturing is significantly enhancing productivity, quality control, and operational efficiency, thereby driving the rapid expansion of China's industrial robotics industry, according to the firm.

For example, the Swiss engineering company ABB Ltd in July launched three new robot product lines at its Shanghai Mega Factory. These robots, embedded with AI and cloud-based features, are tailored to mid-sized and small enterprises seeking flexible, scalable automation solutions. Industry experts expect such innovations to further bolster market expansion.

Humanoid and AI-powered robots

As China's population ages and the labor pool contracts, demand is expected to grow for humanoid robots capable of handling complex tasks in both industrial and service settings. These AI-powered robots mimic human form and behavior, expanding their use cases beyond traditional factory lines.

Moody's Ratings highlighted that artificial intelligence is expected to supercharge robot capabilities, facilitating their integration into daily life.

China has led the world in humanoid-related patent filings over the past five years, with 5,688 filings compared to 1,483 in the United States, according to Morgan Stanley's February research note.

For instance, Chinese tech giant Baidu Inc has partnered with UBTech Robotics, a Chinese robots manufacturer, to integrate its large language model, Ernie Bot, into the latter's Walker S humanoid robot.

Morgan Stanley forecast an adoption push for humanoids in China in the second half of 2025, with large state orders driving downstream deployments. Significant commercial deals involve companies like UBTech Robotics and Unitree Robots supplying humanoids to automotive and telecom giants.

The investment bank projects the global humanoid robotics industry to reach a value of $5 trillion by 2050, with China expected to lead in both technological development and adoption. By that year, China is forecast to have 302.3 million humanoid units in use, compared to 77.7 million in the United States.

Competitive shift in global robotics

Foreign robot manufacturers are facing increasing competition from agile Chinese firms that leverage rapid innovation, advanced supply chains, and lower costs, according to Moody's.

Foreign brands' market share in China's industrial robot market fell from over 70 percent in 2020 to 53 percent in 2023, while Chinese suppliers have achieved double-digit sales growth every year since 2020. Domestic robot producers have expanded their global presence, with exports growing steadily. Chinese firms' share of the local robotics market has surged from 29 percent in 2015 to 47 percent in 2023.

Total industrial robot production soared from 33,000 units in 2015 to approximately 560,000 in 2024, representing a 17-fold increase. Service robot output, including popular household devices like robot vacuums, reached 10.5 million units in 2024, up from 9.2 million in 2021.

Despite the remarkable progress, Moody's cautions that the robotics sector faces significant long-term challenges, particularly fears of mass job displacement and the potential misuse of autonomous machines.

Contact the writer: liazhu@chinadailyusa.com