The Hong Kong Special Administrative Region government has announced the pricing of approximately HK$27 billion worth of green bonds and infrastructure bonds, denominated in Hong Kong dollars, renminbi, US dollars, and euros.

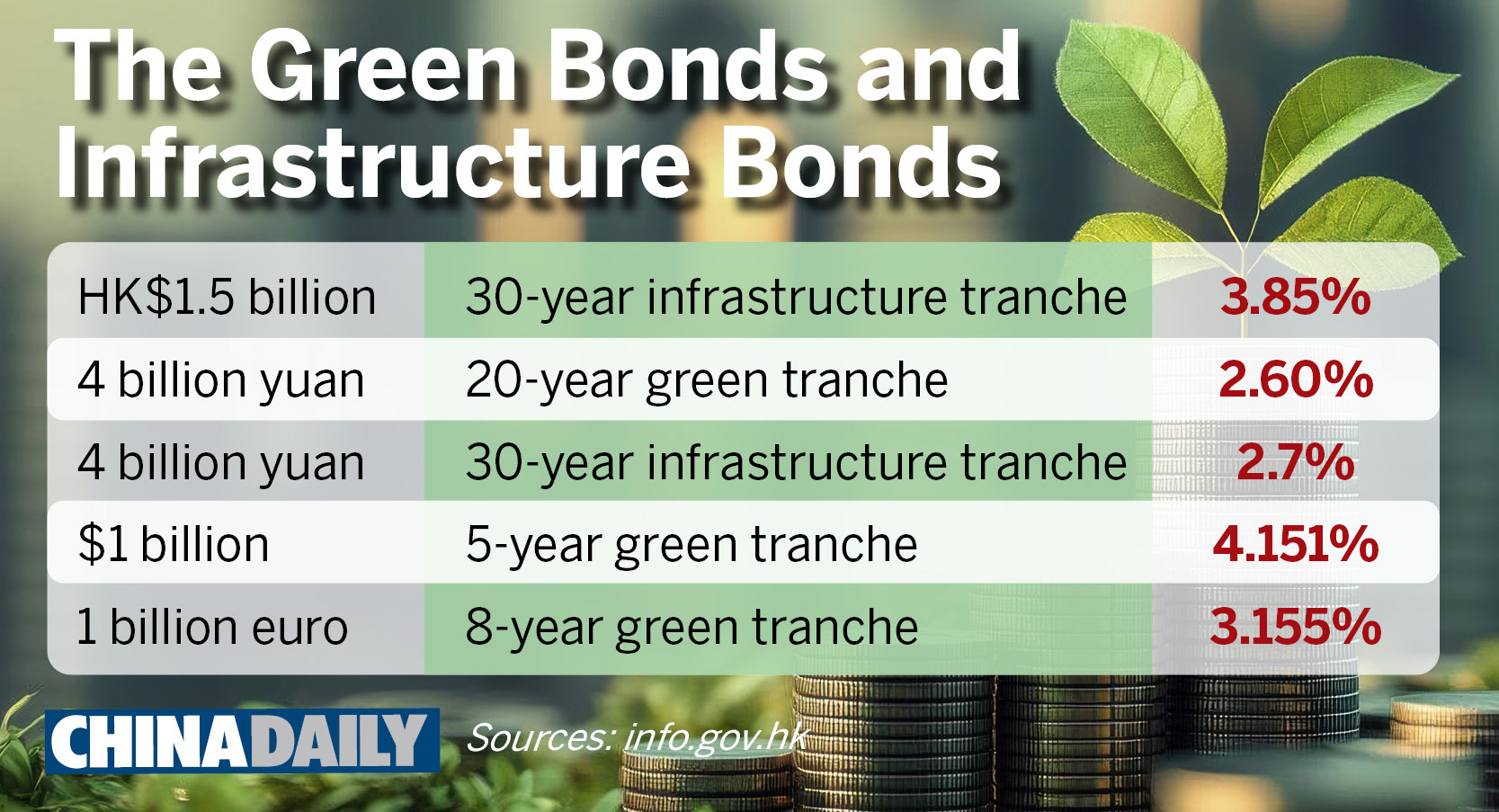

A day after a virtual roadshow on Monday, the bonds were priced as: 1.5 billion 30-year infrastructure tranche at 3.85 percent; 4 billion yuan 20-year green tranche at 2.6 percent; 4 billion yuan 30-year infrastructure tranche at 2.7 percent; $1 billion five-year green tranche at 4.151 percent; and 1 billion euro eight-year green tranche at 3.155 percent, according to a government news release.

The issuance of green bonds under the Government Sustainable Bond Programme and the Infrastructure Bond Programme aims to attract and channel market capital to support green projects, promoting sustainable development in Hong Kong, the city’s financial secretary said on Wednesday.

READ MORE: Mainland sustainability bonanza beckons for HK green finance

“The issuance of infrastructure bonds helps to accelerate the development of projects such as the Northern Metropolis and facilitate the early completion of projects for the good of the economy and people's livelihood,” said Paul Chan Mo-po.

According to the government, the offering attracted participation from over 30 markets across Asia, Europe, the Middle East, and the Americas, with the total order amounting to around HK$237 billion equivalent, representing a subscription ratio of around 3.3 to 12.5 times.

The Hong Kong Monetary Authority (HKMA) highlighted that the HK dollar 30-year bond, offered for the first time by the SAR government, is the longest-tenor HK dollar bond issued by the local government so far.

The 20-year and 30-year RMB bonds also received overwhelming support, doubling in issuance size from last year.

READ MORE: HK raises $2.55b in retail green bonds amid immense response

“Global institutional investors responded enthusiastically to the subscription, fully reflecting their confidence in Hong Kong’s sound public finance and long-term development,” Chan said, adding that the inaugural offering of the 30-year HK dollar government bonds helps to extend the HK dollar benchmark yield curve, further promoting the development of the local bond market.

The green bonds and infrastructure bonds are expected to be settled on June 10, and listed on the Hong Kong Stock Exchange as well as the London Stock Exchange.

These bonds have been assigned credit ratings of AA+ by S&P Global Ratings and AA- by Fitch.