SEOUL/HANOI - Shares in South Korean and Vietnamese steelmakers, major Asian exporters of the metal to the United States, dropped on Monday after US President Donald Trump said he would double tariffs on imported steel and aluminium to 50 percent.

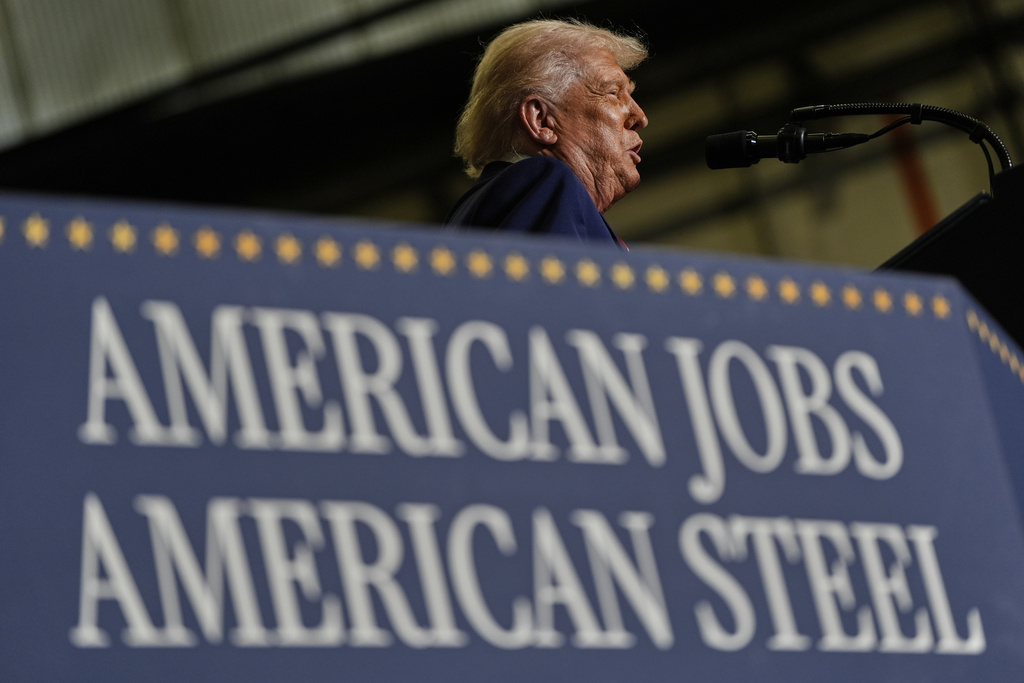

Trump announced on Friday the new steel and aluminium levies, which take effect on June 4, intensifying a global trade war.

Steel industry experts said while the increased tariff would cause significant disruption for major exporters to the US, the rates could go down in light of some of Trump's trade policy reversals.

"Frequent shifts in the Trump administration's tariff policies introduce considerable uncertainty regarding the actual impact ... I think the final result will be far lower than initially projected, especially concerning its duration," said Chelsea Ye, senior analyst at metals research firm McCloskey.

South Korea's Industry Ministry said on Monday it will respond to the 50 percent tariff on steel products as part of its trade discussions with Washington in order to minimize the impact on industry.

South Korea was the fourth-biggest exporter of steel to the United States last year, behind Canada, Mexico and Brazil, according to American Iron and Steel Institute data.

South Korea's Industry Ministry said in a statement that it had held an emergency meeting with officials from the country's major steelmakers, including POSCO and Hyundai Steel.

Shares of South Korean steelmakers lost ground on Monday, with POSCO and Hyundai Steel falling 3 percent and SeAH Steel Corp down 6.3 percent in morning trade.

In Vietnam, major steelmakers Hoa Sen Group and Nam Kim Steel fell 2.8 percent and 3.4 percent respectively. Vietnam Steel Corp also fell 2.7 percent.

ALSO READ: S. Korea vows more support measures over US tariffs, including for drugmakers

Vietnam's exports of steel and steel products to the US fell 27 percent in the first four months of this year, government data showed.

The 50 percent tariffs will add to the challenges facing Korean steel exporters, which have refrained from sharply boosting exports to the US to avoid Washington's scrutiny, despite rising US steel prices, an industry executive told Reuters.

"It will be a burden to exporting companies, if there are no additional steel price increases in the US," he told Reuters, asking not to be identified due to the sensitivity of the issue.

Despite tariffs, South Korea's steel shipments to the United States rose 12 percent in April from a year earlier, according to trade data.

Steel and aluminium tariffs were among the earliest Trump imposed when he returned to office in January. The tariffs of 25 percent on most steel and aluminium imported to the US went into effect on March 12.

Industry officials said the tariffs have increased US steel prices, affecting several sectors, including home appliances, cars, and construction.

Trade talks

South Korea, a major US ally, has called for an exemption from tariffs on steel, autos and others items, during talks with the United States.

Seoul agreed in late April to craft a trade package by the end of the 90-day pause on Trump's reciprocal tariffs in July, but it has been difficult for negotiators to make big decisions due to a political leadership vacuum ahead of elections on Tuesday.

In late March, Hyundai Steel announced a plan to build a $5.8 billion factory in Louisiana in response to US tariffs, but the factory will not open until 2029. In April, Hyundai Steel's bigger rival POSCO signed a preliminary deal to make an equity investment in the factory project.

In India, which relies heavily on the US for aluminium exports, industry experts also warned of a major hit.

"This is going to have a detrimental impact," B.K. Bhatia, director-general at the Federation of Indian Mineral Industries, the country's leading mining body, told Reuters.

"The US is the biggest market for Indian aluminium. Government has been negotiating so we are hopeful that with talks, the tariffs will come down."

The US is the world's largest steel importer, excluding the European Union, with a total of 26.2 million tons of imported steel in 2024, according to the Department of Commerce. As a result, the new tariffs will likely increase steel prices across the board, hitting industry and consumers alike.

READ MORE: South Korea, US aim for trade package before tariff pause ends in July

"The latest hike will prompt these sellers to renegotiate with their US buyers on how to and who will shoulder the extra 25 percent cost," said Thaiseer Jaffar, founder of Dubai-based steel industry event organizer Global Steel Summit.