Credit rating agency Fitch has maintained Hong Kong’s “AA-” rating and stable outlook, which the government said is a recognition of the special administrative region’s strong credit fundamentals.

Besides recognizing the city’s strong credit fundamentals, including large fiscal buffers, robust external finances, and a low level of fiscal debt, Fitch Ratings also pointed out that Hong Kong’s banking sector is resilient, with solid funding and liquidity, the HKSAR government said in a statement on Friday.

“Hong Kong's financial system remains robust, with a consistently healthy level of overall asset quality in the banking sector according to international standards. Bank deposits have continued to grow,” said a government spokesman.

As of the end of March this year, the total amount of bank deposits in Hong Kong was near HK$18 trillion, marking an 11 percent year-on-year increase, according to the government.

Data showed the continuous reinforcement and enhancement of the city’s status and functions as an international financial center, the spokesman. “The confidence of global investors in Hong Kong is strengthening. The capital markets are active.”

For the stock market, the Hang Seng Index rose 18 percent last year and has increased by over 15 percent since the beginning of this year, the spokesman added.

The total market capitalization of Hong Kong stocks has exceeded HK$41 trillion. The average daily turnover in the first four months of 2025 surpassed HK$250 billion, representing a 144 percent increase compared to the same period last year.

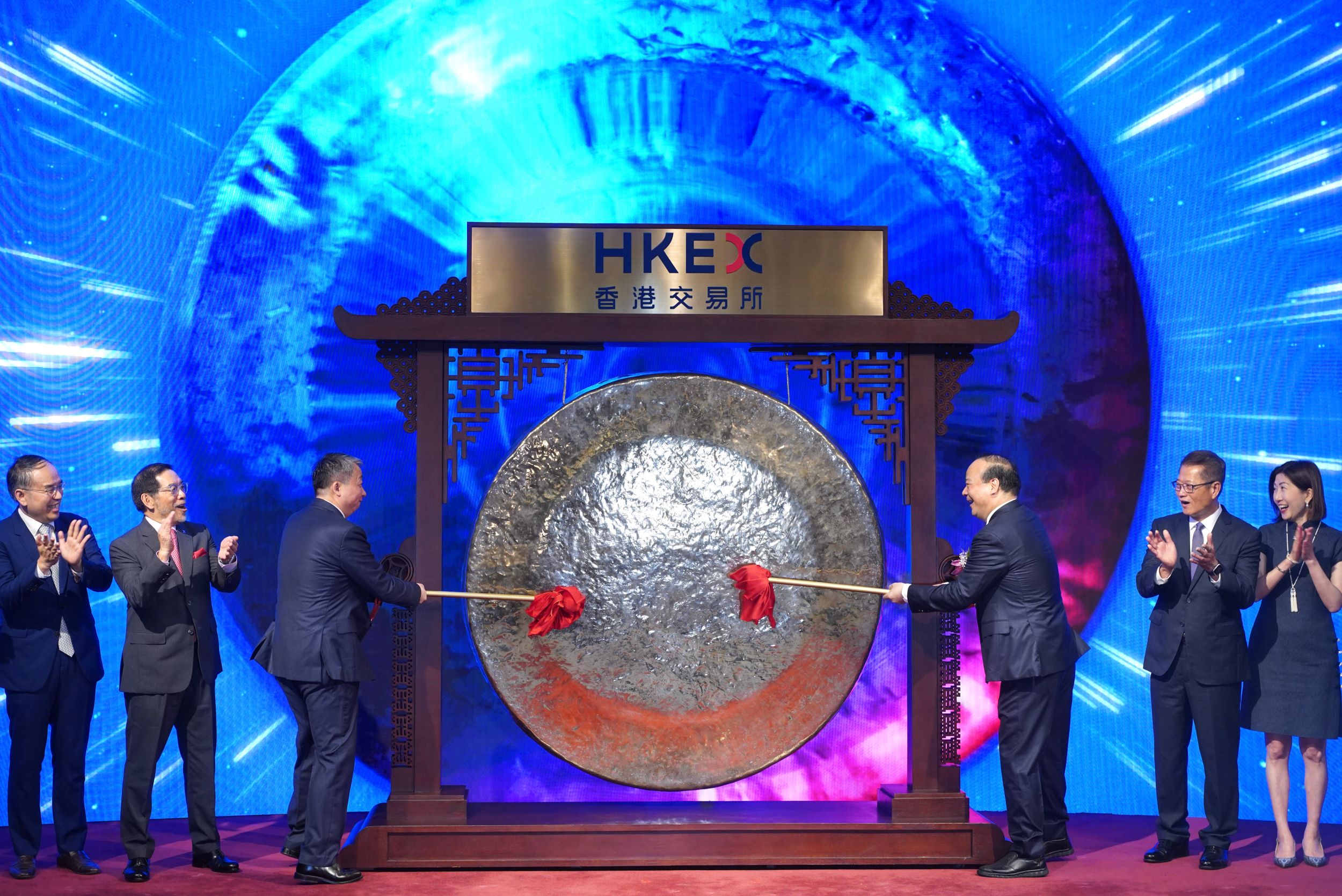

“The initial public offering market is also thriving, with cumulative funds raised exceeding HK$60 billion. This week, the Hong Kong Exchanges and Clearing Limited welcomed the world's largest IPO activity so far this year,” the spokesman said referring to the Hong Kong debut of battery maker Contemporary Amperex Technology Co., Limited.

ALSO READ: Chinese firms’ stellar HK debuts spur hopes of valuation shift

Pointing out that the HKSAR government’s fiscal situation has remained robust, the spokesman said reinforced fiscal consolidation was set out in the 2025-26 Budget.

The Operating Account is expected to be largely balanced in this financial year and will return to surplus in the next financial year, ie 2026-27.

The Capital Account mainly involves capital works expenditure, which represents investments for the future, such as the development of the Northern Metropolis. Therefore, the SAR government will make flexible use of market resources, including increasing the scale of bond issuance, to fast-track the related projects, said the spokesman.

“Even if so, the level of deficit in the Capital Account will gradually decrease starting from the 2026-27 financial year. Overall, after counting the proceeds from bond issuance, the Consolidated Accounts will return to surplus in the 2028-29 financial year.”

Pointing out that the tariff war has increased global economic uncertainty and the world economy is facing broad challenges, the government spokesman said, “However, international trade tensions have recently eased to a certain extent, and the (Chinese) mainland's economy has continued to grow steadily, supported by more proactive fiscal policies and moderate expansionary monetary policies. These will benefit the trade performance in Hong Kong and the region.”

The mainland's high-level two-way opening up and pursuit of green transition, innovation and technology, and digital economy will continue to create business and investment opportunities for the SAR, according to the government.

Leveraging its unique advantages of connecting with both the mainland and the rest of the world under the “one country, two systems” arrangement, Hong Kong attracted more mainland and international companies to establish international headquarters, research and development centers and regional offices in the city to expand their global business. In 2024, the number of companies in Hong Kong with parent companies located outside the city increased to nearly 10,000, reaching a new historical high.

As a “super-connector” and “super value-adder”, Hong Kong will continue to actively link the mainland with the world, said the spokesman.

“While reinforcing connections with traditional markets, we will also forge more economic and investment networks with new markets, particularly those in the Global South.”

Hong Kong will deepen integration with the Guangdong-Hong Kong-Macao Greater Bay Area, enabling the city to open up new growth points and inject greater impetus into its economy, added the spokesman.