Intervention from authorities to weaken the Hong Kong dollar has spilled over to the options market, helping drag the cost to short the currency to an all-time low.

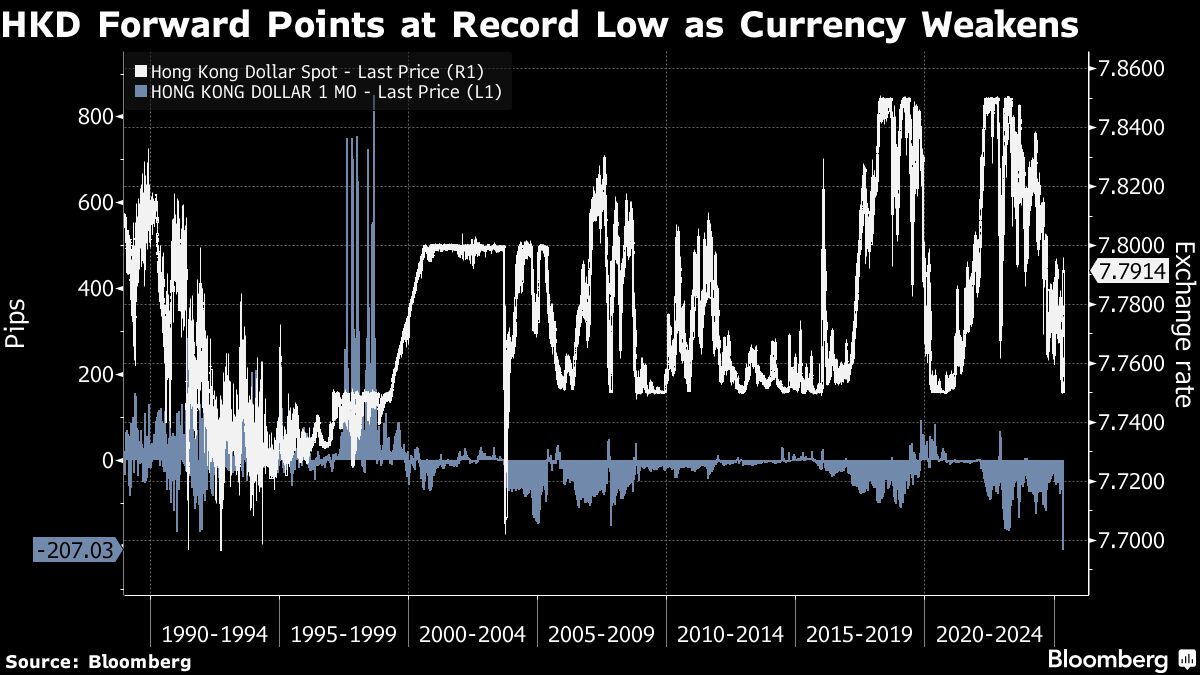

One-month forward points on the city’s dollar, which are added to or subtracted from the spot level to calculate the forward rate, dropped to the lowest on record Tuesday, according to data compiled by Bloomberg.

The Hong Kong dollar has weakened toward the midpoint of its 7.75 to 7.85 per greenback trading range, retreating from the strong end of the band. That’s after the city’s monetary authority intervened via heavy sales of the local dollar last week, a move that boosted liquidity in the market, lowered borrowing costs and thereby reduced the appreciation pressure on the currency.

Demand for Hong Kong dollars in the capital market had been high of late as investors from the Chinese mainland poured money into stocks there this year. Currency conversions related to dividend payments by mainland companies listed in the city were also a factor.

“The very flush liquidity is leading to one-month forward points falling to a record low,” said Carie Li, global market strategist at DBS Bank Ltd in Hong Kong. “Then record low forward points make it attractive for market players to reload short Hong Kong dollar positions.”

ALSO READ: HK's FX reserves seen as ‘enviable’ arsenal to defend HK dollar

“One month Hong Kong dollar forwards will likely rebound in the coming months when Hong Kong dollar demand grows. A return to around -100 is possible,” she said.

One-month forward points for the greenback versus Hong Kong dollar fell from about -30 earlier this month to around -220 following recent currency intervention from the city’s authorities.

Options traders are taking advantage of the low cost and putting on bullish US dollar positions such as call spreads versus its Hong Kong counterpart, according to Nathan Swami, Singapore-based head of FX trading for Asia Pacific at Citigroup Inc. That’s a strategy investors often use when they see a moderate rise in the price of a currency pair.

“We are seeing renewed interest in USD/HKD call options,” Swami said. “Forwards remain cheap and investors are looking to go long.”

The one-month Hong Kong Interbank Offered Rate fell further on Tuesday to the lowest since 2022 while the local dollar consolidated just below the 7.80 per greenback level.

The flood of Hong Kong dollars in the market is sinking local rates, “crashing” the currency back to the 7.79 level, said Ken Cheung, chief Asian foreign-exchange strategist at Mizuho Bank Ltd. The surge in cash offering led to the return of short Hong Kong dollar positions, he said, adding that it “drove the front-end Hong Kong FX swap curve lower”.

Cheung expects the Hong Kong dollar to return to 7.77-7.78 range when the currency’s liquidity conditions normalize.