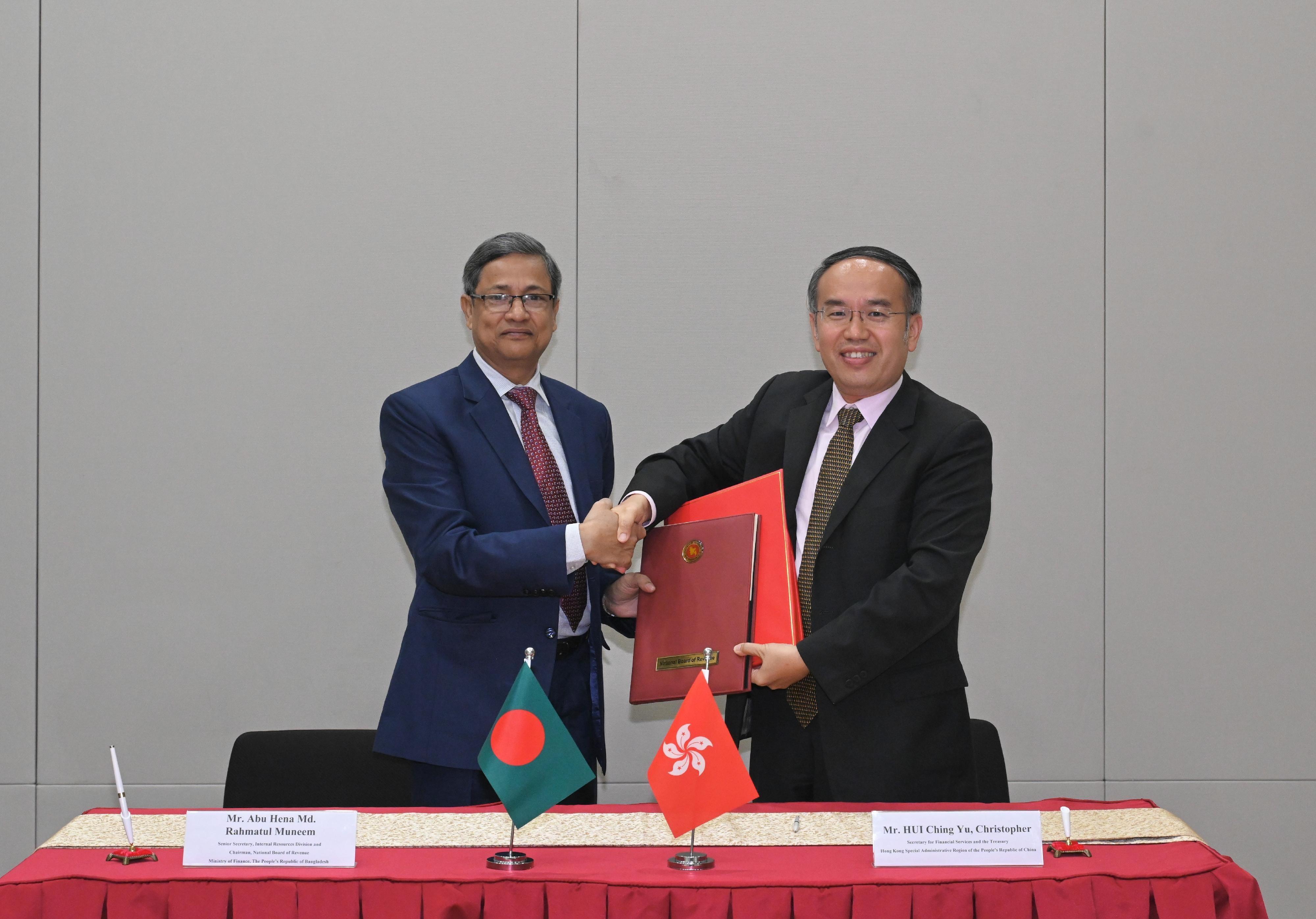

Secretary for Financial Services and the Treasury Christopher Hui Ching-yu (right) exchanges documents with Senior Secretary of the Internal Resources Division and Chairman of the National Board of Revenue of the Ministry of Finance of Bangladesh Abu Hena Md. Rahmatul Muneem (left), after signing a comprehensive avoidance of double taxation agreement on Aug 30, 2023. (PHOTO / HKSAR GOVERNMENT)

Secretary for Financial Services and the Treasury Christopher Hui Ching-yu (right) exchanges documents with Senior Secretary of the Internal Resources Division and Chairman of the National Board of Revenue of the Ministry of Finance of Bangladesh Abu Hena Md. Rahmatul Muneem (left), after signing a comprehensive avoidance of double taxation agreement on Aug 30, 2023. (PHOTO / HKSAR GOVERNMENT)

HONG KONG- The Hong Kong Special Administrative Region government signed a comprehensive avoidance of double taxation agreement (CDTA) with Bangladesh on Wednesday.

Secretary for Financial Services and the Treasury Christopher Hui Ching-yu signed the CDTA, signifying the HKSAR government's sustained efforts in expanding Hong Kong's CDTA network, in particular with tax jurisdictions participating in the Belt and Road Initiative.

The CDTA is the 47th of such agreement that the HKSAR has concluded with its trade partners

The CDTA is the 47th of such agreement that the HKSAR has concluded with its trade partners.

ALSO READ: In Bangladesh, HK firm pulls shared prosperity out of 'hat'

Representing Bangladesh was Senior Secretary of the Internal Resources Division and Chairman of the National Board of Revenue of the Ministry of Finance of Bangladesh Abu Hena Md. Rahmatul Muneem, who was accompanied by Consul-General of Bangladesh in Hong Kong Israt Ara.

"Bangladesh is one of the economies participating in the Belt and Road Initiative,” Hui said. “I have every confidence that this CDTA will further promote economic and trade ties between Hong Kong and Bangladesh, and offer additional incentives for the business sectors of both sides to do business or make investment."

Under the agreement, double taxation will be avoided as any tax paid in Bangladesh by Hong Kong companies will be allowed as a credit against the tax payable in Hong Kong, and vice versa.

Besides, Bangladesh's withholding tax rates for Hong Kong residents on dividends will be capped at 10 percent or 15 percent, depending on the percentage of their shareholdings, while those on interest, royalties and fees for technical services will be capped at 10 percent.

READ MORE: HK grants over HK2.2m for flood relief in Bangladesh

Hong Kong residents deriving profits from international shipping transport in Bangladesh will also enjoy 50 percent tax reduction there.

This CDTA will come into force after being approved by related authorities of both sides.