This picture taken on Dec 11, 2019, shows an oil tanker at the port of Ras al-Khair, about 185 kilometers north of Dammam in Saudi Arabia's eastern province overlooking the Gulf. (GIUSEPPE CACACE / AFP)

This picture taken on Dec 11, 2019, shows an oil tanker at the port of Ras al-Khair, about 185 kilometers north of Dammam in Saudi Arabia's eastern province overlooking the Gulf. (GIUSEPPE CACACE / AFP)

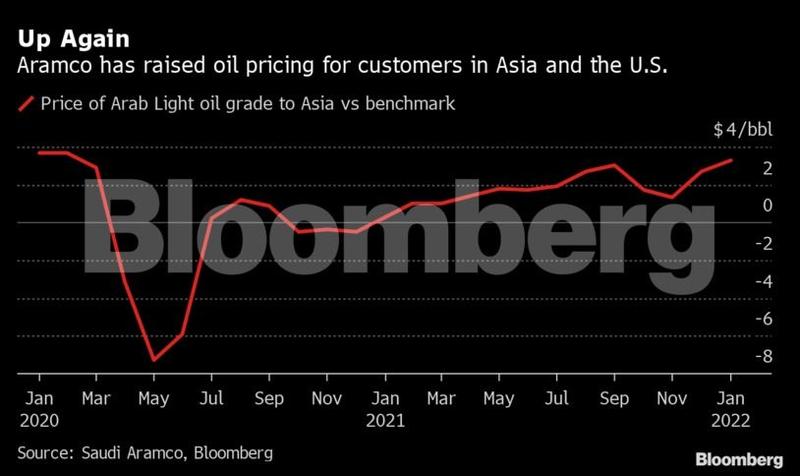

Saudi Arabia raised oil prices for buyers in Asia and the US, signaling it sees demand staying strong despite the spread of the Omicron variant of the coronavirus.

The move comes days after the Organization of Petroleum Exporting Countries and its allies – a 23-nation group led by Saudi Arabia and Russia – surprised traders with a decision to boost crude output.

Saudi Aramco raised its key Arab Light grade for customers in Asia by 60 cents from December to $3.30 a barrel above a benchmark

Saudi Aramco increased January’s prices for all crude grades that will be shipped to Asia and to the US, according to a statement from the state producer. The company raised its key Arab Light grade for customers in Asia by 60 cents from December to $3.30 a barrel above a benchmark. That’s the most expensive it’s been since February 2020, around when the pandemic first struck.

ALSO READ: US to release oil from reserves in challenge to OPEC+

Prices for the US will go up by between 40 and 60 cents. Those for Europe, a relatively small market for Aramco, will be cut.

OPEC+ opted on Thursday to proceed with a production increase for next month, even as new COVID-19 cases threaten to sap demand and with the alliance predicting the oil market will flip from a supply deficit to a surplus in early 2022.

Brent crude is down 15 percent since late November to just below $70 a barrel, reducing this year’s gain to 35 percent. The fall is mainly due to the discovery of Omicron and the prospect of more barrels coming on to the market from OPEC+ and major importers such as the US, who want to lower domestic fuel costs.

While Aramco’s price increase was in line with a Bloomberg survey of traders and refiners in Asia, it suggests bullishness on the part of its management. Chief Executive Officer Amin Nasser said last week he was “very optimistic about demand” and that the market had over-reacted to Omicron.

Saudi Arabia is the world’s biggest oil exporter. It sends more than 60 percent of its crude shipments to Asia, with China, Japan, South Korea and India being the biggest buyers.

READ MORE: OPEC+ countries agree to boost oil production

Aramco’s official selling prices, or OSPs, serve as a bellwether for oil markets and often lead the pricing trend in the region. Most Middle Eastern countries set monthly prices as a premium or discount to a benchmark.