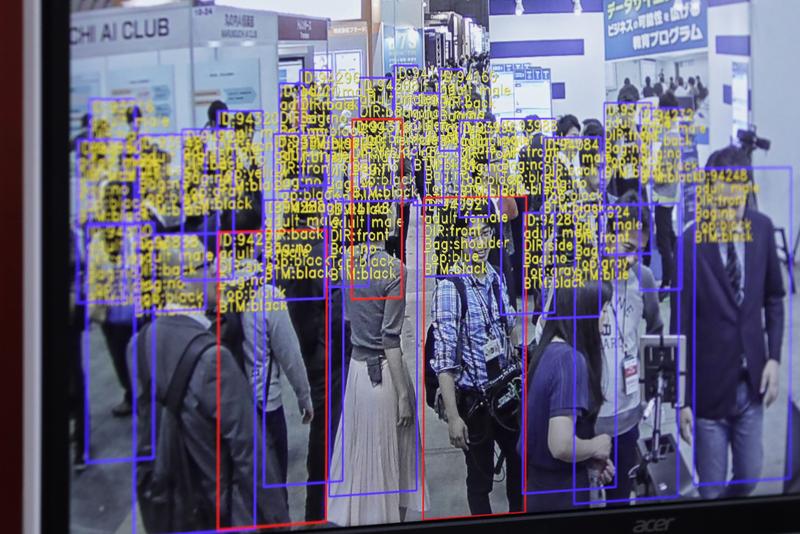

The object detection and tracking technology developed by SenseTime Group Ltd is displayed on a screen at the Artificial Intelligence Exhibition & Conference in Tokyo, Japan, on Apr 4, 2018. (KIYOSHI OTA / BLOOMBERG)

The object detection and tracking technology developed by SenseTime Group Ltd is displayed on a screen at the Artificial Intelligence Exhibition & Conference in Tokyo, Japan, on Apr 4, 2018. (KIYOSHI OTA / BLOOMBERG)

SenseTime Group, the Chinese mainland’s leading artificial intelligence company, is planning to raise HK$5.65 billion ($724.3 million) in its Hong Kong initial public offering.

SenseTime announced Monday that the amount being raised assumes an offer price of HK$3.92 per share, the midpoint of the offer price range of between HK$3.85 and HK$3.99 a share.

SenseTime is a “unicorn” — a startup with a value of over $1 billion. The company is losing money but its revenue is growing.

Subscriptions open on Tuesday and close on Friday. The final offer price and allocation results will be announced on Dec 16. Trading will begin on Dec 17 under the ticker “0020”. The Class B shares will be traded in board lots of 1,000 shares each

Subscriptions open on Tuesday and close on Friday. The final offer price and allocation results will be announced on Dec 16. Trading will begin on Dec 17 under the ticker “0020”. The Class B shares will be traded in board lots of 1,000 shares each.

SenseTime, which is backed by the SoftBank Group Corp, is readying to go public just as market sentiment has been soured in the wake of Didi Global Inc’s announcement that it is delisting its American depositary shares from the New York Stock Exchange.

Market volatility due to scrutiny of the tech sector by the Chinese mainland regulatory authority has compelled some companies to trim their public offerings. SenseTime is not required to undergo a cybersecurity review.

The sell-off in Chinese tech shares continued Monday, while the Hang Seng Index recorded its biggest drop in two months, Bloomberg data show. On Friday, travel retailer China Tourism Duty Free Group suspended its $5 billion public float in Hong Kong.

SenseTime said it plans to offer 1.5 billion Class B shares. Nine cornerstone investors have subscribed to about $450 million, or 60 percent of the deal. These investors are Mixed Ownership Reform Fund, Guosheng Overseas HK, Shanghai AI Fund, SAIC HK, GF Fund, Pleiad Funds, WT, Focustar, and Hel Ved.

SenseTime co-founder, Executive Chairman and CEO Xu Li said he believes the listing will help propel future growth. The company has evolved “into the largest leading AI software company in Asia in terms of revenue, empowering a broad range of industries,” he added.

SenseTime was founded by a team that included Xu, Tang Xiao’ou, Wang Xiaogang and Xu Bing — all renowned AI scientists. Tang founded the Chinese University of Hong Kong Multimedia Lab in 2001.

SenseTime was incorporated in Hong Kong in 2014. It is based in the Science Park in Sha Tin.

ALSO READ: AI firm SenseTime Group files for Hong Kong IPO

The company recorded net losses in 2018, 2019, 2020 and the first half of 2021 of 3.43 billion yuan ($537.9 million), 4.96 billion yuan, 12.15 billion yuan and 3.71 billion yuan respectively. The historical net losses were also mainly attributable to fair-value losses of preferred shares.

Revenue increased from 1.85 billion yuan in 2018 to 3.03 billion yuan in 2019. And in 2020, revenue grew to 3.45 billion yuan.

In the first half of this year, revenue increased by 91.8 percent from the year before to 1.65 billion yuan.

Gross profit margin increased from 56.5 percent in 2018 to 56.8 percent in 2019. It grew to 70.6 percent in 2020. In the first half of 2021, the gross profit margin grew to 73 percent compared with 72.1 percent in the comparable period of the year before.

A new AI data center in Shanghai due to open early 2022 will be a key catalyst for SenseTime to cement its leadership of China’s computer vision AI market and help drive greater software-as-a-service (SaaS) revenue, Bloomberg Intelligence technology analysts Matthew Kanterman and Tiffany Tam say.

The data center will increase SenseTime’s supercomputing capacity to 4.9 exaFLOPs vs. 1.2 exaFLOPs before its launch. This will enable SenseTime to deepen its customer relationships, co-design and develop new AI models cost effectively with them and commercialize these models via a cloud-delivered as-a-service model, they say.

Heavy losses may continue for the next few years amid continuing investment in research and development, the analysts said.

Citing a commissioned Frost & Sullivan report, SenseTime says in its prospectus it is a leading AI software company and the largest in Asia in terms of revenue in 2020.

As of June 30, 2021, its software platforms had been used by more than 2,400 customers.

The Hang Seng Index tumbled by 417.31 points, or 1.76 percent at the close Monday. The Hang Seng Tech Index shed 198.03 points, or 3.34 percent. Main board turnover was HK$170.02 billion.