HONG KONG - Hong Kong economy's contraction sees pacing down at the start of 2021 amid a rise in the latest benchmark index, according to London-based consulting firm IHS Markit on Wednesday.

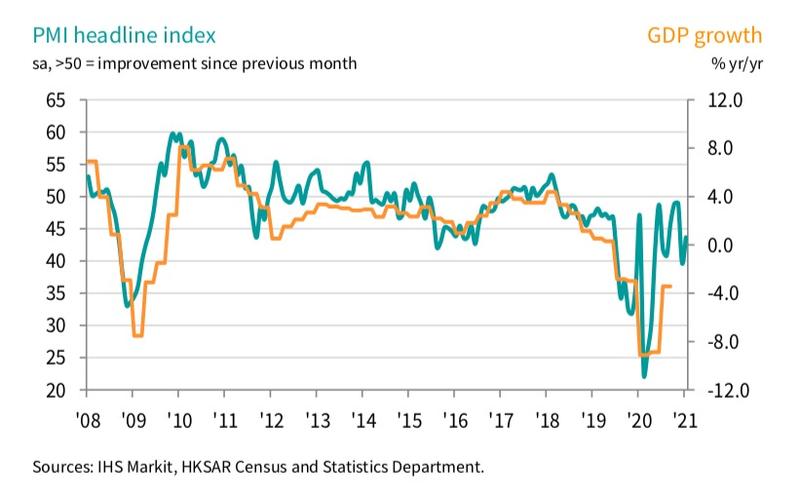

Hong Kong's Purchasing Manager's Index (PMI) climbed to 47.8 in January from 43.5 in December, signaling a moderation in the rate of deterioration after the heavy hit from the reintroduction of COVID-19 related restrictions, according to IHS Markit's survey

Hong Kong's Purchasing Manager's Index (PMI) climbed to 47.8 in January from 43.5 in December, signaling a moderation in the rate of deterioration after the heavy hit from the reintroduction of COVID-19 related restrictions. However, it remained below 50 and was therefore in the contraction territory, according to IHS Markit's survey.

ALSO READ: Nov PMI reaches highest level in over two and a half years

Although Hong Kong's economic downturn eased compared to the steep decline seen in December, business confidence was knocked further due to intensified worries about the COVID-19 pandemic, according to the survey .

"Hong Kong saw a difficult start to the year, with business activity slumping once again as companies struggled against the ongoing headwind of COVID-19, both at home and abroad. Domestic demand and export sales sank sharply lower, supply delays rose at an unprecedented rate, and worries about further waves of the virus knocked firms' confidence in the near-term outlook," said Chris Williamson, chief business economist at IHS Markit.

Output, exports and new orders continued to fall at steep rates. Although rates of decline eased compared to December, the downturns were the second-steepest since August. The drop in exports was fueled in part by a further marked loss of business from the Chinese mainland.

Purchasing activity meanwhile sank the lowest since August, in part due to companies scaling back buying due to weaker sales. Suppliers’ delivery times lengthened to the greatest extent since the survey began in 1998, signalling an unprecedented incidence of supply constraints.

Looking ahead to the coming 12 months, the number of pessimistic firms increasingly outnumbered those who were optimistic compared to December due to heightened concerns over the duration of the pandemic, both at home and in export markets.

However, business expectations remained far higher than what was seen throughout much of last year as firms focused on the prospect of life returning to normal with the roll-out of vaccines. A further contraction of the economy looked inevitable in the first quarter, but the longer-term picture has brightened, Williamson said.

READ MORE: HK's GDP down 6.1% in 2020, economic woes lessen in Q4

Thomas Shik, chief economist and head of economic research with Hang Seng Bank, noted that the latest PMI reading reflected that Hong Kong economy is still facing short-term downside risks amid the pandemic.

Despite the low base in the first quarter of last year and the imminent supply of vaccines to Hong Kong, consumer sentiment was still declining amid tightened social distancing measures, Shik said. He said the economic performance in the first quarter will be similar to that in the fourth quarter of last year.

It’s likely that companies have begun to adapt to anti-epidemic measures, and the economy is hovering at the bottom. If the outbreak is eased and control measures are relaxed, the economy is expected to record growth in the second half this year, he said.

He Shusi contributed to this report