This undated file photo shows a woman walking past a billboard of Kuaishou, a short video app, in Beijing. (PHOTO BY A QING / FOR CHINA DAILY)

This undated file photo shows a woman walking past a billboard of Kuaishou, a short video app, in Beijing. (PHOTO BY A QING / FOR CHINA DAILY)

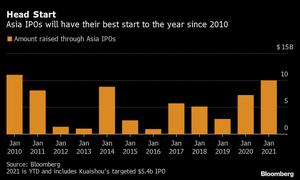

The world’s biggest internet initial public offering since Uber Technologies Inc is set to make this the best start to a year for stock listings in Asia since 2010.

Kuaishou Technology’s Hong Kong Special Administrative Region IPO of as much as US$5.4 billion will push the amount raised through first-time share sales in the region in 2021 to US$9.93 billion, the most for a January month in 11 years, data compiled by Bloomberg show. Almost US$11 billion was raised in January 2010.

Kuaishou Technology’s Hong Kong Special Administrative Region IPO of as much as US$5.4 billion will push the amount raised through first-time share sales in the region in 2021 to US$9.93 billion, the most for a January month in 11 years

The bumper start comes against a backdrop of ebullient regional markets that continue to hit records amid a flood of liquidity from central banks trying to stave off the economic damage from the coronavirus pandemic.

The continuing boom in Asia share listings follows on from the trend seen last year globally, where investors piled into offerings in search for returns, sending company valuations soaring on their debuts. Globally, IPOs are having their best start to the year on record, driven predominantly by listings in the US which account for 85 percent of proceeds worldwide, Bloomberg-compiled data show.

Blank check companies are continuing their fundraising spree from last year, with almost US$24 billion raised in the US so far. That represents 66 percent of the money fetched from first-time share sales globally. The blank check IPOs are spreading to Asia too, with many eyeing assets in the region.

ALSO READ: Mainland's Kuaishou HK IPO 'could value firm at US$60b'

The latest was a US$260 million IPO by Bridgetown 2 Holdings Ltd, a special purpose acquisition company backed by billionaires Richard Li and Peter Thiel, that is targeting businesses in the technology, financial services or media sectors in Southeast Asia.

Kuaishou, the operator of Chinese mainland’s most popular video service after ByteDance Ltd’s Douyin, appears to have picked the right time to go public.

The Tencent Holdings Ltd-backed startup will stop taking orders from institutional investors two days earlier than planned, a sign of very strong investor demand. It has already reserved around 45 percent of the shares it is offering for high-profile cornerstone investors.

READ MORE: ByteDance rival Kuaishou mulls US$5 billion Hong Kong IPO

Earlier IPOs have also proved popular with investors, particularly mom and pop buyers. Health-care technology company Yidu Tech Inc soared 148 percent on its debut this month after retail investors put in orders for 1,634 times the shares initially made available to them.