Passengers walk towards the check-in area at London Heathrow Airport Ltd in London, UK, Dec 19, 2020. (CHRIS RATCLIFFE / BLOOMBERG)

Passengers walk towards the check-in area at London Heathrow Airport Ltd in London, UK, Dec 19, 2020. (CHRIS RATCLIFFE / BLOOMBERG)

A brutal ending is taking shape for what’s already been a lost year for Europe’s travel industry, as COVID-19 administers a final kick to airlines and rail firms, innkeepers and travelers alike.

Shares of British Airways-owner IAG SA fell as much 20 percent while EasyJet Plc, the UK’s biggest discount carrier, dropped 18 percent

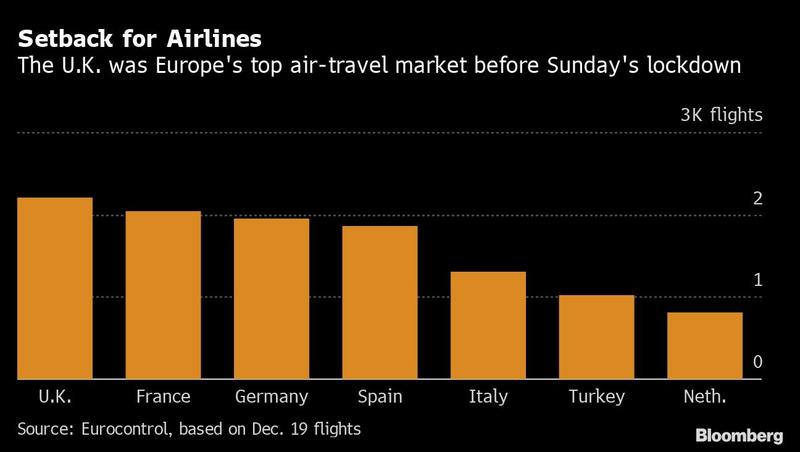

A mutant strain of the coronavirus spreading rapidly in the UK led Prime Minister Boris Johnson to clamp down on holiday visits at home and abroad over the weekend. Airlines shares tumbled as Italy, the Netherlands and Belgium closed their borders to the former European Union state, with others preparing to follow suit.

Airlines that were seeing a glint of the typical holiday bustle are now canceling flights or sending planes out empty so stranded Brits can return. UK hoteliers and operators of holiday lets are coming up empty during one of the busiest times of the year. Train operators contended with chaos over the weekend amid a rush to leave London, while travelers hoping to squeeze in a visit to family or a sunny getaway are spending time on the phone seeking refunds.

ALSO READ: Asia wary, monitoring new UK strain

“Fundamentally no one expected winter to be good,” Citigroup analyst Mark Manduca said of the airline industry’s year-end swoon. “We knew it was going to be bad, it is bad, it just turns out it’ll be very bad.”

Shares of British Airways-owner IAG SA fell as much 20 percent while EasyJet Plc, the UK’s biggest discount carrier, dropped 18 percent. Ryanair Holdings Plc slumped 8 percent and Wizz Air Holdings Plc 11 percent. Tour operator TUI AG slid 12 percent.

Before the latest lockdowns, airlines anticipated offering just under a million seats this week between the UK and western Europe, said Anne Correa, vice president for airline and airport services at consulting firm Morten Beyer & Agnew. While that’s down by more than two-thirds from a year ago, the run-up to Christmas was supposed to be one of the few bright spots for the industry this year.

EasyJet and Ryanair could see the biggest impact on passenger numbers, since they sell 49 percent of the seats between the UK and Europe, she said. London Heathrow, Britain’s busiest airport, began suffering cancellations Sunday, with the upheaval extending to terminals including the London City business hub, which reported a significantly reduced schedule.

“These bans are going to lead to the disruption of travel plans for thousands of travelers and the loss of peak revenues for the airlines,” said John Strickland of JLS Consulting.

Bearing the brunt

Who pays is often dependent on the fine print of plane and train tickets that few read until a crisis hits. On social media, customers engaged in refund battles with airlines, train operators and ticket brokers.

Some airlines like EasyJet quickly said they’ll offer cash refunds to customers whose travel was disrupted, while IAG SA’s British Airways and long-haul specialist Virgin Atlantic Airways Ltd. said they’ll limit compensation to vouchers or waive change fees.

Irish discounter Ryanair said Sunday it’ll provide refunds where EU countries ban travel between Dec 20 and Dec 24, but not to other countries to which the airline is permitted to fly.

Stranded travelers

Stranded travelers

Beyond the damage to their wallets, would-be travelers found their plans dashed. Twitter user Franchesca_3 said she was unable to board a flight from Britain to Sweden, where she is moving, on Sunday because it would stop in Amsterdam, where the Netherlands had prohibited UK arrivals. She said she’s hoping to get to her destination before Sweden follows with its own ban.

Those thwarted trying to leave the UK risk being stranded without a place to stay. The Premier Inn Wimbledon Broadway in south London said it was open but anyone booking a room must prove they are there for a legitimate reason such as business, by showing a letter or email.

Operators of small holiday lettings were also out of pocket. Airbnb told customers they may get a refund if travel is restricted, under a policy put into place before the latest rules were enacted.

Cottages.com, Britain’s biggest provider of self-catering accommodations, told proprietors it was contacting all guests who live in a Tier 4 area - including London and much of southeast England - to cancel reservations and offer a later booking or refund.

Scotland will move to Tier 4, the most severe UK lockdown category, from Dec 26 through at least mid-January, while in Wales, all holiday accommodation must close, Cottages.com said.

Trains and cabs

Rail stations serving express routes out of London were packed on Saturday night amid an exodus ahead of the new rules. Some travelers rented cars or booked taxis for journeys spanning hundreds of miles to flee the capital and be with loved ones for the holidays.

The Department for Transport said on its website it will ensure that refunds are paid to all domestic rail and long-distance bus passengers who have canceled travel in England between Wednesday and Sunday, the previous Christmas travel window abandoned over the weekend.

Eurostar International Ltd said it will refund passengers unable to travel on its trains through the Channel Tunnel, though the impact will be limited by demand already running at less than 30 percent of the usual Christmas level. Motorists planning to travel to France on Eurotunnel’s vehicle shuttle were also unable to do so.

READ MORE: Europe sharpens restrictions to regain grip on pandemic

Manduca, the Citigroup analyst, said the chaos at year-end would likely have a knock-on effect, causing some travelers to delay making bookings in the early part of the year for summer travel.

While he expects negative sentiment on airline stocks in the short-term, he said low-cost carriers such as Ryanair could benefit from pricing power when travel snaps back. Airlines have become more nimble with costs and can more easily adapt to shorter booking lead-times, he said.

“I don’t think it’ll have a big impact on the fundamentals,” he said. “Summer may be quite good.”