In this file photo, investors watch price movements on screens at a securities company in Beijing. (GREG BAKER / AFP)

In this file photo, investors watch price movements on screens at a securities company in Beijing. (GREG BAKER / AFP)

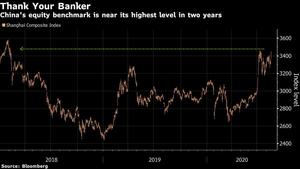

China’s move to pump cash into its banking system has fueled bets monetary policy will remain loose, driving the benchmark gauge near its highest level in more than two years.

The Shanghai Composite Index climbed 2.3 percent to 3,438.80 at the close. Financials led the gains, with China Merchants Securities Co and China Life Insurance Co both jumping by the 10 percent daily limit. Monday morning, the People’s Bank of China added 700 billion yuan (US$101 billion) of one-year funding via the medium-term lending facility in a sign it wants to ease monetary policy to help the economy recover from the coronavirus pandemic.

ALSO READ: China's central bank injects liquidity into market

“The MLF today eased market concern over tight liquidity conditions,” said Shen Zhengyang, an analyst with Northeast Securities Co. “Investors are betting on stocks with cheap valuations, like financials amid expectations of an economic recovery. The gains will likely spread to more sectors in coming days, and overall trading will remain active.”

The Shanghai gauge has risen 13 percent in 2020, the most among the world’s major benchmarks

The Shanghai gauge has risen 13 percent in 2020, the most among the world’s major benchmarks. The gains have been propelled by investors binging on debt, with total leverage rising to the highest in five years, amid bets Beijing’s containment of the virus outbreak is successful and it will roll out stimulus to aid growth. Authorities took measures last month to instigate a slow bull market, while the outlook is challenged by escalating China-US tensions.

READ MORE: China's central bank injects US$14.17b into market

“The stock market is likely to maintain a gradual upward trend,” said Liang Bin, chairman at Shenzhen Benly Investment Management Co. “Investors see the recent regulatory environment and monetary policies as friendly to the market, so there is limited downside for the stock market right now.