In this April 23, 2014 photo, Warren Buffett, chairman and chief executive officer of Berkshire Hathaway Inc, smiles during a Bloomberg Television Interview in New York, US. (PHOTO / BLOOMBERG)

In this April 23, 2014 photo, Warren Buffett, chairman and chief executive officer of Berkshire Hathaway Inc, smiles during a Bloomberg Television Interview in New York, US. (PHOTO / BLOOMBERG)

Shares of Berkshire Hathaway Inc were left out of the stock market rally in the second quarter. Warren Buffett clearly thought the disconnect wasn’t warranted.

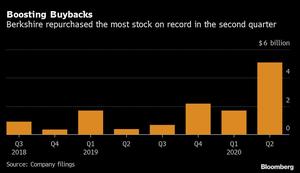

The famed investor spent a record US$5.1 billion buying back Berkshire’s own stock in the second quarter, more than double the amount he’d ever purchased before. That came as he unloaded almost US$13 billion of other companies’ shares, including airline stocks and some financials, in what was his biggest selling quarter in more than a decade.

Buffett has been building up cash this year and took a more cautious tone at his annual meeting in May as the COVID-19 pandemic has slammed the economy without putting a permanent dent in stock-market valuations. But his appetite for his own stock in the second quarter, along with recent signs that he’s been willing to put more money to work, are reasons for some optimism, according to Jim Shanahan, an analyst at Edward Jones.

ALSO READ: Buffett's Berkshire sells all airline stocks amid pandemic

“The buybacks are a relatively safe way to deploy capital in an uncertain environment,” said Shanahan, who estimated that Berkshire repurchased another US$2.4 billion of shares in July. “But it’s clear that that’s not all he’s doing.”

Boosting buybacks

Buffett’s cash pile surged to a record US$146.6 billion at the end of June, in part from dumping all of his airline shares in April. He’s been more active lately, striking a deal for natural-gas assets in July and snapping up at least US$2 billion of Bank of America Corp stock in recent weeks through Aug 4.

The sense that I get from the magnitude of the writedown and the tone of some of the comments related to air travel, and the industry supporting air travel, is that there’s some demand destruction there that could be permanent or semi-permanent.

Cathy Seifert, Analyst, CFRA Research

Overall, Saturday’s disclosures signaled to longtime shareholder Bill Smead that Berkshire is a bit more certain about its standing in this volatile environment.

“He sees that the company itself can get through the worst body blow,” said Smead, the chief investment officer at Smead Capital Management, which oversees US$1.5 billion including Berkshire shares. And his buybacks signal that “it got obvious to him how out of favor his own stock is in relation to other investments you could make in other companies.”

Berkshire’s Class A shares, which fell in line with the S&P 500 in the first three months of the year as the pandemic spread in the US, fell another 1.7 percent last quarter while the broader index rallied 20 percent.

Buffett said in early May that repurchases weren’t more compelling than at previous times, but the buybacks in the quarter suggest his thinking shifted.

The company’s stock has rallied in July and August, with Shanahan attributing that to investors being encouraged by Berkshire’s recent deals, but it’s still underperforming in 2020. Berkshire Class A shares were down 7.4 percent for the year through Friday’s close, compared with the 3.7 percent gain in the S&P 500.

Berkshire’s operating profit slumped 10 percent in the second quarter to US$5.5 billion. That was driven by a 42 percent drop in earnings from the conglomerate’s manufacturing, service and retailing businesses.

The company also took US$10 billion of impairment charges related to its Precision Castparts unit. Berkshire bought Precision Castparts in 2016 in a transaction valued at US$37.2 billion, making it one of Buffett’s biggest deals. Now the maker of jet-engine blades and aircraft structural components is bracing for lean times as Boeing Co and Airbus SE cut jetliner production and less air travel reduces the need for replacement parts.

The impairment charge “reflects a very ample purchase price combined with some secular challenges,” Cathy Seifert, an analyst at CFRA Research, said in an interview.

ALSO READ: Warren Buffett's firm adds to Apple, Teva investments

“The sense that I get from the magnitude of the writedown and the tone of some of the comments related to air travel, and the industry supporting air travel, is that there’s some demand destruction there that could be permanent or semi-permanent.”

The challenges have forced the aerospace-parts maker to undergo “aggressive restructuring,” with the company cutting its workforce by about 10,000 employees during the first half of 2020.

“We believe the effects of the pandemic on commercial airlines and aircraft manufacturers continues to be particularly severe,” Berkshire said in a regulatory filing Saturday. “In our judgment, the timing and extent of the recovery in the commercial airline and aerospace industries may be dependent on the development and wide-scale distribution of medicines or vaccines that effectively treat the virus.”

Other key takeaways from the results:

Unrealized gains and losses in Berkshire’s massive stock portfolio count toward the bottom line. So the S&P 500’s rally in the second quarter pushed net income to US$26.3 billion.

Insurance underwriting profit more than doubled to US$806 million in the period. That was helped by gains at auto insurer Geico as fewer accidents benefited the business. Berkshire warned that Geico might be hurt in the next three quarters by a program that’s giving drivers a credit on their premiums.