After a dreadful March quarter for Asian corporations, investors are bracing for another wave of reporting cards that will reflect the first full three-month period during the worst virus outbreak in living memory.

The members on the gauge that have reported second-quarter earnings so far saw an average decline of 73 percent on year, according to data compiled by Bloomberg. That’s after a 64 percent fall in the previous three-month period, which was the worst in data going back to 2011

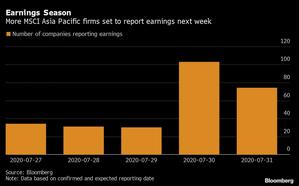

More than 280 companies on the MSCI Asia Pacific Index are expected to report results next week, and the number will continue to climb in August.

The members on the gauge that have reported second-quarter earnings so far saw an average decline of 73 percent on year, according to data compiled by Bloomberg. That’s after a 64 percent fall in the previous three-month period, which was the worst in data going back to 2011.

ALSO READ: IMF warns of deep global recession

The coronavirus pandemic and social distancing have fueled growth of companies that cater to homeworking and online entertainment, and accelerated the demise of brick-and-mortar stores. With better positioned firms taking market share from their competitors, investors see profits becoming more polarized in this reporting season.

“The gap between winners and losers will widen,” said Olivier d’Assier, head of applied research for Asia Pacific at Qontigo. “Any company whose core business could be conducted online will show positive surprises, any company whose core business requires human interaction will disappoint.”

The trend is apparent in those that have reported so far. Take Taiwan Semiconductor Manufacturing Co. The chip supplier to Apple Inc’s iPhone this month raised its outlook for 2020 revenue and spending after posting second-quarter profit that beat the most bullish analyst’s estimate, thanks to demand from high-end computing and 5G smartphones. The stock surged to a record high close on Friday.

ALSO READ: IMF to revise down Asia-Pacific growth forecast amid pandemic

Top Glove Corp, the world’s largest glove maker and Asia’s top gainer this year, last month posted its strongest ever quarterly earnings for the February-May period, driven by supernormal demand during the pandemic.

In contrast, companies with traditional business models, such as retailers, airlines or shopping malls are suffering as demand disappeared. Companies including Hong Kong’s flagship carrier Cathay Pacific Airways Ltd warned of a US$1.3 billion first-half loss. Meanwhile, Singapore landlord Capitaland Ltd has forecast a profit slump.

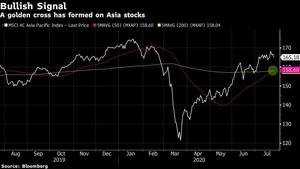

Thanks to the stimulus measures from policy makers across the region and the reopenings of some economies, Asia’s equity benchmark has risen more than 4 percent in its fourth-straight monthly gain since the pandemic rattled global financial markets. The regional gauge is set to beat the S&P 500 Index for a second month in a row. The MSCI Asia Pacific Index fell 0.3 percent in early Monday trading.

ALSO READ: China's economic rebound augurs well for future

Similar to the US, the spotlight will be on Asia’s tech giants as winners of structural changes triggered by the outbreak, and expectations running are high. Chinese gaming behemoth Tencent Holdings Inc. is expected to report 36 percent growth in operating profit for the past quarter, while a 12 percent increase is forecast for its rival Alibaba Group Holding Inc, according to data compiled by Bloomberg.

All eyes will also be on management comment on the business outlook, given the uncertainty in the length and impact of the pandemic.

“Key variables to watch will be provisioning policies and views from banks regarding non-performing loans, as well as capacity utilization levels for goods producing firms to gauge whether and at which speed demand converges to normal levels, ”said Hartmut Issel, the head of APAC equities at UBS Global Wealth Management Chief Investment Office.

READ MORE: South Korea enters recession as exports sink to 57-year low