Hong Kong one-hundred dollar and five-hundred dollar banknotes are arranged for a photograph in Hong Kong, China, on Thursday, April 23, 2020. (PAUL YEUNG / BLOOMBERG)

Hong Kong one-hundred dollar and five-hundred dollar banknotes are arranged for a photograph in Hong Kong, China, on Thursday, April 23, 2020. (PAUL YEUNG / BLOOMBERG)

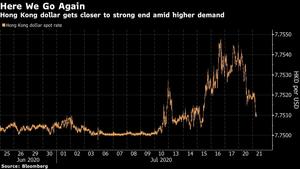

Demand for the Hong Kong dollar is swelling before a mega Chinese mainland share sale in the special administrative region, ending the currency’s brief period of weakness.

The city’s currency traded at 7.7509 per greenback Tuesday morning, back near the strong end of its trading band at 7.75

The city’s currency traded at 7.7509 per greenback Tuesday morning, back near the strong end of its trading band at 7.75. That’s the case even as its yield advantage over rates on the US dollar shrank to the narrowest since February, making a carry trade less appealing.

The local dollar traded at 7.7515 as of 5:25 pm Hong Kong time.

The demand for the currency was boosted by a report that billionaire Jack Ma’s Ant Group is seeking a dual-listing in Hong Kong and Shanghai that promises to be one of the largest debuts in years.

The Hong Kong dollar fell to a nearly two-month low last week after the Hong Kong Monetary Authority had sold US$13.7 billion of the currency since April to defend its foreign-exchange peg. The intervention pushed interest rates on the city’s currency lower, narrowing the premium over the greenback’s rates.

ALSO READ: HK dollar strength on inflows shows 'security law effective'