As the global pandemic continues to hammer supply chains worldwide, business experts warn the city’s trade-industry players that they need to diversify sourcing bases, integrate the entire supply-chain management, and invest in technologies.

Hong Kong urgently needs to innovate in its role as a key regional logistics hub, given that the coronavirus pandemic has severely disrupted and continues to adversely affect the global supply chain, industry experts say.

The World Trade Organization expects international trade will contract 13 to 32 percent this year because of weakened consumer demand and investment in the current quarter, as well as disruptions of supply chains and shipping routes that resulted from national lockdowns to curb the spread of the virus.

The economic efficiencies generated by extreme specialization of production and just-in-time inventories will now be weighed against the vulnerabilities in global supply chains if even just one link in the chain breaks down. In the delicate balancing act between economic efficiency and security of supply, the pendulum is swinging back toward security.

“A move to more regional supply chains, as already is the case in the auto and electronics sectors, could accelerate the shift to domestic production of critical goods, such as pharmaceuticals and food,” US-based credit rating agency Moody’s Investors Service said in a research report.

“The crisis has also laid bare the vulnerabilities of just-in-time supply chain management and could prompt companies to consider moving supply chains closer to their final markets and building redundancies. Data flows and trade in digital services may accelerate as more consumption and work shift online,” the report said.

The key problems created by the pandemic for supply chains include cancellations or delays of business orders; suspension of production in sourcing countries; and blocked or delayed shipments.

Buyers cited cash-flow challenges caused by dwindling sales; shop closures due to governments’ anti-pandemic measures; and constraints in reaching out to suppliers and producers in sourcing countries resulting from travel bans as the three major obstacles.

Poor cash flow, a dearth of business orders, manufacturing delays caused by a shortage of raw materials, and rising production costs are some of the pandemic-created hurdles for producers in supply-chain management.

Reflecting serious disruptions in regional supply chains and related trading, Hong Kong’s exports fell by 8.1 percent year-on-year in the first four months of this year. The city’s goods exports fell nearly 10 percent in the first quarter of 2020 from a year earlier — visibly larger than the 2.5 percent drop in the preceding quarter.

Looking ahead, in addition to Sino-US economic and trade relations, the Hong Kong government expects geopolitical tensions and global financial market volatility to continue warranting attention. Amid a still-austere external environment, Hong Kong’s export performance will remain under pressure in the near term.

“Businesses and governments are actively seeking a greater hedge against dependency risk in trade. Policies encouraging more domestic production, and to keep more of what’s produced at home, are being implemented across developed and developing economies,” Hinrich Foundation Research Fellow Stephen Olson said in an article published for the East Asia Forum in May.

William Deng, Greater China and North Asia economist at UBS Investment Bank, said that Hong Kong is facing a unique set of challenges. “North Asia is likely to face more distortions in productions due to supply-chain interruptions. For an economy like Hong Kong, its recovery is likely to be a lot more challenging, given it was weak to start with,” he said.

OCBC Wing Hang Bank Economist Carie Li expects Hong Kong’s exports and imports to show negative growth for the second consecutive year in 2020 despite the low base from 2019. “Specifically, the huge demand shock associated with global economic shutdowns will inevitably weigh on Hong Kong’s trade activities,” she said.

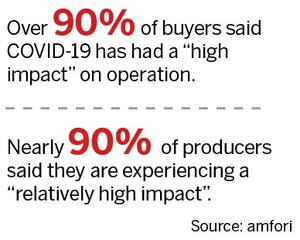

How serious is the jolt on buyers and producers as a result of the pandemic?

More than 90 percent of buyers said the COVID-19 crisis has had a “high impact” on their operations, while nearly 90 percent of producers said they are experiencing a “relatively high impact”, according to a survey carried out in the first half of April by Amfori, a global business association for open and sustainable trade that comprises over 2,400 retailers, importers and brands from more than 40 countries.

The association asked 162 members in 17 nations, as well as 405 producers in the top 10 sourcing countries, what they thought of the pandemic’s impact on world supply chains.

Logistics and trade-industry players are urged to diversify their sourcing bases, integrate the entire supply-chain management, and invest in technologies amid the new business environment.

Hedging risks

“Diversifying the sourcing base will be the first major trend. The Chinese mainland will remain the major sourcing country, but an element of strategic alliance among buyers, especially consumer product companies, will jointly monitor the pandemic risks to reduce the effects,” Amfori President Christian Ewert said.

“Producers also need to rethink their production strategies to bolster the vertical integration between upstream and downstream producers to minimize the disruption of raw material delivery as witnessed in the case of COVID-19,” Ewert said, adding that buyers and producers should look to investment in technologies in supply-chain management.

Global business advisory firm PwC said COVID-19 will further hasten the sector’s digital transformation process as the advantages of e-commerce continue to emerge, and the digital switch will accelerate.

In the logistics process, big-data analytics can assist firms in streamlining their supplier selection process, while cloud computing is increasingly being used to facilitate and manage supplier relationships. The better the data integration, the better companies can do due diligence, and the better companies can plan for the future.

“Stronger supply-chain management and digitalization have never been more important. Companies with effective supply-chain risk management will be well positioned to identify the impact of disruptive events on their supply-chain and products, giving them an opportunity to assess how to best respond in tough circumstances,” said Anne Petterd, technology, communications and commercial partner at Baker and McKenzie .

Ewert told China Daily: “Hong Kong’s logistics sector can always do better in the digitalization of supply chains, while the industry needs to consider providing customized logistics solutions in general in the market.”

Anna Lin, CEO of GS1 Hong Kong, the local chapter of global standard organization GS1, said that more cooperation in the supply chain is vital. “When supply-chain partners start collaborating and sharing information, it can bring magnificent values as the intelligence derived from every partner can be leveraged to improve processes, reduce costs, and increase profit margins. This could also be recognized not only in local business, but also in cross-border trade,” she said.

GS1 Hong Kong advocates GS1 barcodes and the Electronic Product Code — the global radio frequency identification (RFID) standard — to track and trace goods as they move through global supply chains.

RFID makes product movements more visible, streamlines distribution, improves demand forecasting, and makes manufacturing more responsive to market changes.

Hong Kong’s small domestic market hinders logistics-service providers in their efforts to adopt REID on a massive scale because the overall benefits are small, Lin told China Daily. Data interoperability, as well as data security and privacy, are also essential for determining the effectiveness of smart technologies in the logistics business.

In February, the Hong Kong government pledged to inject HK$345 million ($44.5 million) into a pilot subsidy program to strengthen the logistics sector’s productivity by applying technologies. Each eligible third-party logistics-service provider will receive subsidies to implement up to four projects, subject to a cumulative subsidy ceiling of $1 million. The plan is expected to benefit about 300 companies.

Contact the writer at oswald@chinadailyhk.com