The Wirecard AG logo sits on elevator floor buttons inside the Wirecard headquarters in Munich, Germany, on Sept 5, 2018. (BLOOMBERG / BLOOMBERG)

The Wirecard AG logo sits on elevator floor buttons inside the Wirecard headquarters in Munich, Germany, on Sept 5, 2018. (BLOOMBERG / BLOOMBERG)

Wirecard AG filed for insolvency, following the arrest of its CEO amid a massive accounting scandal that left the German payment-processing firm scrambling to find over $2 billion dollars missing from its balance sheet.

The company’s rapid fall from grace comes after it admitted that 1.9 billion euros (US$2.1 billion) went missing from its balance sheet, and is a major setback for Germany’s burgeoning tech scene and a debacle for investors

Wirecard management cited over-indebtedness as the reason behind the decision to seek court protection in Munich, according to a statement. The company also said it’s considering whether the insolvency proceedings should also be applied to its subsidiaries.

ALSO READ: Wirecard, once Germany’s pride, turns national embarrassment

Wirecard Bank is not included in the proceedings, according to a person familiar with the matter, who asked not to be named, as the situation is private. German regulator BaFin is responsible for deciding whether a bank should file for insolvency, although there are also other measures it can take when a lender runs into trouble.

The company’s rapid fall from grace comes after it admitted that 1.9 billion euros (US$2.1 billion) went missing from its balance sheet, and is a major setback for Germany’s burgeoning tech scene and a debacle for investors.

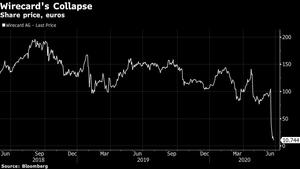

In less than a week, the company once hyped as the future of German finance had seen its shares and bonds collapse and its former Chief Executive Officer Markus Braun arrested in an accounting-fraud probe after almost two decades at the helm of the company.

Wirecard’s shares plunged 80 percent to 2.50 euros in Frankfurt after trading resumed. Its 500 million euros of bonds due 2024 fell 6 cents on the euro to a record low of 12 cents on Thursday, according to data compiled by Bloomberg.

ALSO READ: Former Wirecard CEO arrested on suspicion of falsifying revenue

The insolvency proceedings leave Wirecard’s creditors facing lengthy negotiations with administrators over how much they’ll get back out of the money they’re owed following the company’s implosion.

Banks who have lent to Wirecard, including Commerzbank AG, ABN Amro, LBBW and ING, have been demanding more clarity from the company in return for the extension of almost US$2 billion in debt.

Wirecard has licenses with Visa, Mastercard and JCB International, through which Wirecard’s banking arm issues its credit cards. If Wirecard is unable to find its missing cash, Visa and Mastercard may have cause to revoke the licenses.

“The big question is whether they retain the Visa and Mastercard licenses,” Neil Campling, analyst at Mirabaud said. “Without those they have no business.”

For Germany, the affair represents an embarrassment. While the country has seen the likes of airline Air Berlin and renewable-energy firm Solarworld file for insolvency in past years, critics say that Wirecard’s troubles could have been spotted earlier.

The crisis began when Wirecard failed to publish its yearly report on June 18, citing the missing cash. In the ensuing days, Wirecard’s stock and bonds collapsed after two Asian banks that were alleged to be holding the funds denied any business relationship with the company. Braun resigned on June 19, and was arrested by Munich prosecutors a couple of days later. He's been since released on bail.

READ MORE: New ways to pay make life easier on the road