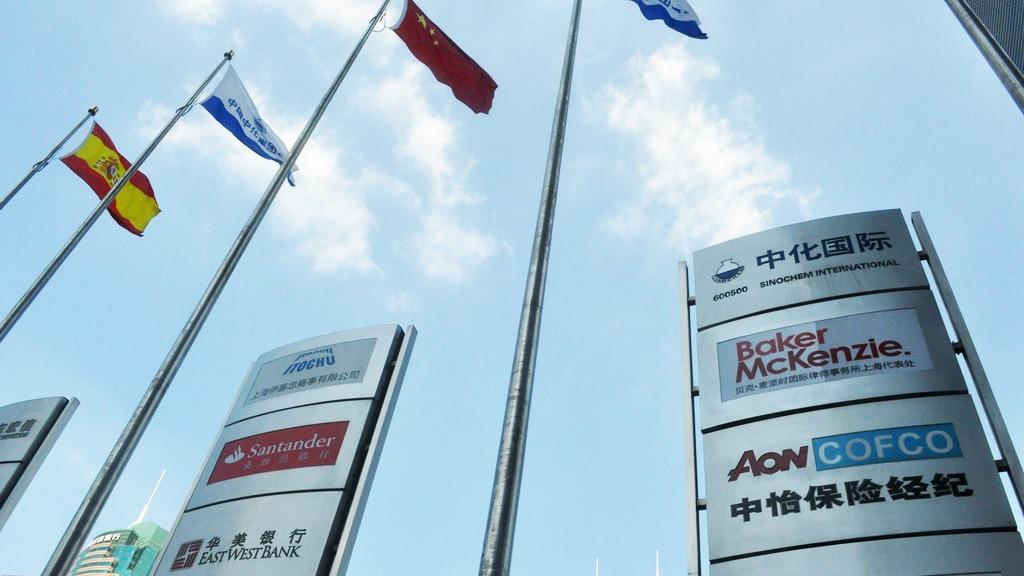

This undated file photo shows signboards of Chinese and foreign banks, companies and other financial institutions in the Lujiazui financial district in Pudong, Shanghai. (PHOTO / IC)

This undated file photo shows signboards of Chinese and foreign banks, companies and other financial institutions in the Lujiazui financial district in Pudong, Shanghai. (PHOTO / IC)

WASHINGTON - More foreign firms have been snapping up Chinese companies despite tensions between the United States and China, including deals in the more sensitive industries of finance and technology, CNBC reported on Monday.

Most of that activity has been driven by American and European firms taking advantage of looser foreign ownership limits or betting on Chinese consumer demand.

A report by CNBC

"Most of that activity has been driven by American and European firms taking advantage of looser foreign ownership limits or betting on Chinese consumer demand," the report reads.

"The market in China is very big and lots of these foreign (corporate) investors, they are looking at the long-term business development in China," Martin Wong, managing partner of the insurance sector for the financial services industry at Deloitte China, was quoted as saying. "They're not looking at the short and medium term."

ALSO READ: Chinese market remains key for multinationals

In the CNBC article, it was also noted that the rising business interest in China contrasts with an increasingly tense geopolitical environment.

Foreign direct investment into the Chinese mainland, in actual use, expanded by 7.5 percent year-on-year to 68.63 billion yuan (US$9.71 billion) in May, said Gao Feng, spokesperson for the Chinese Ministry of Commerce, at a press conference on June 18.

In a recent Rhodium Group report, it was pointed out that one reason for the investment trend is that in some industries, "Chinese businesses have now become leaders -- partly through the rise of start-ups and government policy support."

"It is important for foreign enterprises, before anything, to be rooted in the Chinese market, serving Chinese customers with the support of the parent company because China is not one market and customer needs are very diverse and demand for advanced digital applications will propel the future," AXA China CEO Xavier Veyry said in an earlier statement to CNBC.

READ MORE: New law gives foreign investors teeth in bite of China market