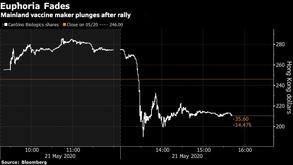

The air has suddenly come out of a rally in a biotech firm that’s been developing a coronavirus vaccine.

CanSino Biologics Inc tumbled as much as 23 percent in Hong Kong trading on Thursday afternoon, erasing an earlier 16 percent surge. The stock had almost tripled since announcing on March 4 it was in the process of developing a vaccine. The rally accelerated after the company said on Monday Canada approved its clinical trial application for a vaccine.

ALSO READ: Canada, China team up on COVID-19 vaccine candidate

The stock had almost tripled since announcing on March 4 it was in the process of developing a vaccine. The rally accelerated after the company said on Monday Canada approved its clinical trial application for a vaccine

The sudden reversal underscores the risks in chasing the most popular theme this year - vaccine producers. Moderna Inc slumped from a record in New York trading earlier in the week as investors digested early data from a small trial of the company’s coronavirus vaccine, as well as a US$1.3 billion stock sale.

Some traders said a series of large transactions may have triggered the selloff in CanSino, with at least 17 trades comprising more than 10,000 shares each changing hands in the afternoon. Eli Lilly & Co is the company’s biggest shareholder with a 15.5 percent stake, according to an April filing.

The firm listed in the Hong Kong Special Administrative Region in March last year, raising US$160 million in a heavily oversubscribed initial public offering. It developed the first Ebola vaccine approved in China for emergency use and national stockpile, it said at at the time. The company has a current market value of US$6.1 billion.

CanSino made no revenue in 2019, according to a March exchange filing. Its operating loss was about 200 million yuan (US$28 million) last year.

Other biotech firms have rallied in Hong Kong as the coronavirus spread across the globe. Viva Biotech Holdings has jumped 65 percent this month, while Shanghai Junshi Biosciences Co has surged to a record. Innovent Biologics Inc slumped nearly 10 percent on Thursday after jumping almost 80 percent since mid-March.

READ MORE: Mainland IPO in stellar HK debut amid biotech craze

CanSino didn’t immediately reply to emails sent to its investor relations and press departments seeking comment on the stock move. An external representative said she couldn’t immediately comment on behalf of the company.

CanSino shares were last down 14 percent, ending a 10-day winning streak. Its 14-day relative strength reached 89 on Thursday morning before the rally reversed. A relative strength index (RSI) measure that’s more than 70 indicates sentiment is overheated on a stock.

CanSino has inked a deal to test and sell a separate Canadian vaccine candidate as the race for immunization intensifies globally, according to a joint press release Wednesday.

In addition to developing its own vaccine together with the Chinese military, CanSino will partner with Vancouver-based Precision NanoSystems Inc to co-develop another potential vaccine.

The company will conduct testing of Precision’s experimental vaccine and has the right to commercialize it in Asia excluding Japan, said the statement.

CanSino’s own vaccine is currently in the second of three phases of human testing and is among five Chinese candidates to have reached that advanced stage -- more than the US and Europe combined.