Commercial and residential buildings are visible in this aerial photograph taken in Shenzhen, where pre-owned property prices climbed more than 10 percent accumulatively last year. (PHOTO / IC)

Commercial and residential buildings are visible in this aerial photograph taken in Shenzhen, where pre-owned property prices climbed more than 10 percent accumulatively last year. (PHOTO / IC)

While the residential property market in key Chinese cities beats a retreat amid the coronavirus outbreak, prices of pre-owned homes in Shenzhen have defied the trend.

Experts warned of speculative activities in the particular market as prices of new homes have been strictly curbed.

In February, data from real estate agency Centaline Property show the average price of pre-owned homes in the coastal city increased 1.38 percent over the previous month, while it already had surged 2.3 percent in January.

According to the National Bureau of Statistics (NBS), the price index of pre-owned homes in Shenzhen soured 0.7 percent in January, while the percentages of Beijing, Shanghai and Guangzhou are less than 0.4 percent.

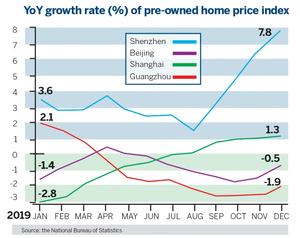

In addition, the growth is on the foundation of a sharp jump at the end of 2019, in contrast to national trend.

According to the NBS, up to one-third of 70 major cities it has tracked have seen their pre-owned home price index fall since the middle of last year.

Among the nation’s four top-tier cities, Beijing’s home prices have been on the wane since July, having gone down accumulatively by 0.5 percent throughout 2019, while Shanghai has seen a 1.3 percent surge.

In contrast, Shenzhen has recorded a noticeable 7.5 percent growth and has been among the nation’s top five spots in terms of month-on-month growth for four consecutive months.

Centaline Property data showed that pre-owned property prices in Shenzhen climbed more than 10 percent accumulatively last year, with the steepest 16.5 percent rise recorded in the upmarket Nanshan district.

Waves of speculation

What has made Shenzhen stand out from the crowd? The southern boomtown in Guangdong province boasts a host of factors. Generally, buyers’ confidence in the property sector has received a remarkable boost following the unveiling of the development blueprint for the Guangdong-Hong Kong-Macao Greater Bay Area last year, as well as the city’s new status as a pilot demonstration zone of socialism with Chinese characteristics.

However, Shenzhen’s new-home price index went up by only 3.6 percent — about half of the pre-owned home price index. Experts have pointed the finger at speculation that was largely responsible for the spectacular jump in pre-owned property prices.

The speculative activities emerged after the Shenzhen government in November waived the value-added tax for residential apartments of less than 144 square meters. The tax accounted for about 5 percent of an apartment’s price and was the largest among taxes for housing transactions.

The new policy sparked a sudden increase in the transaction volume. The municipal real estate authority said a total of 8,013 units changed hands in November — up a staggering 92 percent over the same period in 2018 and the highest in three years.

The surge gave ammunition to some homeowners who urged all residents in their communities to “protect the value of their properties”, claiming that housing prices in nearby projects were “skyrocketing”.

At Zhongliang Fenghuangli Garden, a “homeowners committee” was set up by a WeChat group in December. It advised all members to jack up their asking prices to between 56,000 yuan (US$8,053) and 65,000 yuan per square meter — an increase of nearly 38 percent over the average price of 47,000 yuan in the first 11 months of last year.

It triggered a chain reaction, with more homeowners in other districts and cities, including the neighboring city of Dongguan, joining in to clamor for an uptick in prices via multiple brokers’ platforms. As a result, prices at these developments were pushed up by as much as 40 percent in a day.

Normally, prices of new homes are set by developers and are allowed by the government to fluctuate within 15 percent of the asking price, but pre-owned home prices are decided by homeowners and buyers themselves.

On the heels of growing speculative activity, Shenzhen’s pre-owned home price index rose 1 percent in December, while those of 70 major mainland cities tracked by the NBS edged up by just 0.1 percent. Shenzhen’s growth in the last month of 2019 was also the highest among the four first-tier cities and the second-highest in the country.

The uptrend forced Shenzhen’s housing authorities to ban sales at Zhongliang Fenghuangli Garden and bar property agencies from sealing deals for the residential complex.

Regulations to be set

Wang Feng, director of the Shenzhen Real Estate Research Center, said earlier this year the municipal government was considering setting up controlled prices for pre-owned apartments and specific evaluation standards for speculation activities.

Stabilizing home prices and cracking down on speculators have been the focus of major mainland local governments in the property sector, in line with the central government’s stance that “homes are built to be inhabited, not for speculation”.

Yan Yuejin, director of the Shanghai-based E-house China Research and Development Institution, said Shenzhen’s long-term regulations are aimed at curbing speculation.

“Local governments in major cities have been implementing respective measures to stabilize the property market, but pre-owned home prices, mostly, have not been included in the past,” he said. Previous measures had mainly focused on new homes and land, including purchase limits, higher down payments and mortgage rates.

Yan said he envisaged other top-tier cities rolling out new regulations for the pre-owned housing market, and forming a comprehensive pricing mechanism for new apartments, pre-owned properties, rental apartments and land.

Governments could also set up a risk alert for a certain price rise range, and strengthen the notification responsibility of property agencies, he suggested.

According to Shenzhen’s annual plan formulated in early 2019, the city’s overall target for increases in pre-owned home prices is set at within 5 percent.

Li Yujia, chief analyst with the Guangdong Housing Policy Research Center, reckoned that transactions in pre-owned properties make up about 70 percent of the total in Shenzhen, signaling a market transition to existing resources.

He agreed that the government’s macro-regulation of the housing market should also cover pre-owned properties accordingly and new measures should be more comprehensive.

“We should turn from one comprehensive policy for one city to one specific policy for one district or residential development,” said Li.