The wealth destruction caused by Monday’s market collapse is reshaping the ranks of the world’s richest people.

Wildcatter Harold Hamm’s fortune plunged by almost half to US$2.4 billion by the end of the day, a drop that bumped him from the 500-member Bloomberg Billionaires Index. Fellow oil magnate Jeff Hildebrand also fell off the ranking while Lukoil PJSC executives Leonid Fedun and Vagit Alekperov lost a combined US$5 billion.

While energy moguls sustained the biggest shellacking in percentage terms, losses cascaded across industries and continents.

The near-term market focus is likely to remain on the virus’s spread across Europe and the US, and on stress in the financial markets

Mark Haefele, UBS Group AG’s chief investment officer of global wealth management

ALSO READ: Top 10 richest people in China

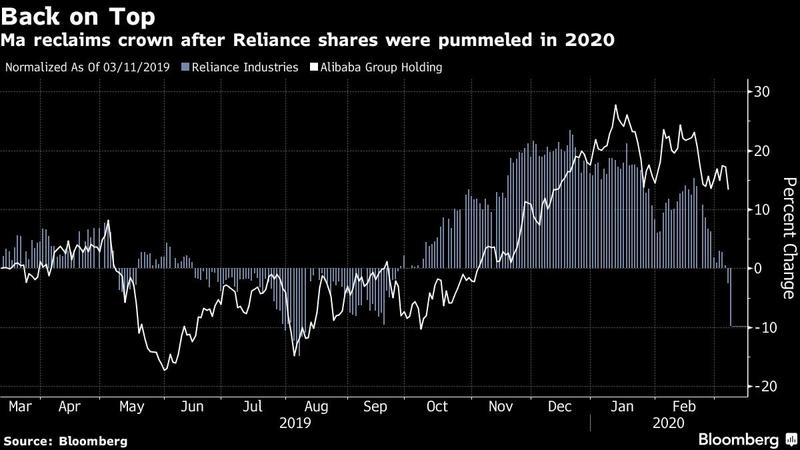

Indian energy tycoon Mukesh Ambani is no longer Asia’s richest man, relinquishing the title to Jack Ma after oil prices collapsed along with global stocks.

The rout, exacerbated by mounting fears that the spread of the novel coronavirus will thrust the world into a recession, erased US$5.8 billion from Ambani’s net worth on Monday and pushed him to No 2 on the list of Asia’s richest people, according to the Bloomberg Billionaires Index. Ma, the Alibaba Group Holding Ltd founder who ceded the No 1 ranking in mid-2018, is back on top with a US$44.5 billion fortune, about US$2.6 billion more than Ambani.

Frenchman Bernard Arnault, chairman of luxury-goods giant LVMH, was Europe’s biggest decliner with a US$4.4 billion drop. Amazon.com Inc founder Jeff Bezos shed US$5.6 billion and Berkshire Hathaway Inc’s Warren Buffett lost US$5.3 billion. Carnival Corp. Chairman Micky Arison’s stake in the beleaguered cruise line operator slid almost 20 percent to US$2 billion.

All told, the world’s 500 richest people lost a combined US$238.5 billion on Monday. That’s the biggest daily plunge since the index began tracking the number in October 2016. The losses include declines in publicly traded assets and estimated drops in the values of private companies -- as is the case with Hildebrand’s Hilcorp Energy -- that Bloomberg calculates using public peers. More than a half-trillion dollars has been erased from the combined fortunes of the top 500 so far in 2020.

“The near-term market focus is likely to remain on the virus’s spread across Europe and the US, and on stress in the financial markets,” Mark Haefele, UBS Group AG’s chief investment officer of global wealth management, said in a note to investors.

READ MORE: Two of world’s richest heirs join forces in Hollywood deal

Spreading Virus

US stocks ended the day down more than 7.5 percent in the worst day on Wall Street since the financial crisis as investors absorbed the prospect of an oil price war triggered by the breakup of the OPEC+ alliance and mounting concerns about how the spreading coronavirus will affect the global economy.

While 92 percent of the index entrants lost money on Monday, there were a few winners.

China’s Qin Yinglin added US$536 million to his net worth as shares of his Muyuan Foodstuff Co rose 4.3 percent. Li Xiting, chairman of Chinese medical equipment maker Shenzhen Mindray Bio-Medical Electronics, gained US$143 million, bringing his net worth to US$13.7 billion.

Two billionaires took to Twitter to urge calm amid the panic. Bridgewater Associates founder Ray Dalio advised to “look for the opportunities” and former Goldman Sachs CEO Lloyd Blankfein stressed the fundamental strength of the US economy.

“Fear” may drive further losses in markets, Blankfein said, “but expect quick recovery when health threat recedes.”