Hong Kong’s defense of its currency peg will likely boost the interbank liquidity pool to a level unseen in two years, lowering local borrowing costs and weakening its dollars.

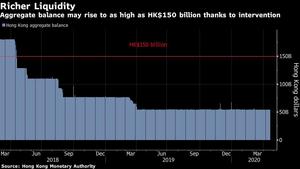

As the authorities sell the city’s currency to protect its peg to the greenback, they inject Hong Kong dollar liquidity into the banking system and boost the city’s aggregate balance. This gauge of interbank cash supply could climb to as high as HK$150 billion (US$19 billion) this quarter, according Scotiabank and OCBC Wing Hang Bank Ltd.

That would narrow the gap between local borrowing costs and the US rates from the widest in two decades -- and make less appealing a carry trade that sent the exchange rate to the strong end of its band for the first time since 2016 this week.

A lowering of borrowing costs would be timely for Hong Kong’s economy as the coronavirus pandemic delivers another major blow after protests rocked the city

A lowering of borrowing costs would be timely for Hong Kong’s economy as the coronavirus pandemic delivers another major blow after protests rocked the city. Lower interest rates typically translate to stronger motivation for corporates and households to borrow, which would facilitate the recovery of growth in the special administrative region.

“I expect the intervention to continue in the coming weeks, and the authorities may spend another HK$50 billion to HK$100 billion to defend the peg,” said Gao Qi, a currency strategist at Scotiabank. “The lower interest rates could help the economy.”

READ MORE: HK dollar gains against the greenback driven by active carry trade

To defend the peg, which allows the city’s currency to move in a narrow range of 7.75 to 7.85 against the greenback, the Hong Kong Monetary Authority has sold the equivalent of US$760 million of its currency so far this week. That’s the first case of intervention on the strong side of the band since 2015. The operation will bring the aggregate balance to HK$65 billion.

A gauge of the Hong Kong dollar’s one-month borrowing costs -- known as Hibor -- was little changed at 1.55 percent Thursday. Its premium over US interest rates remains elevated at around 100 basis points, suggesting buying the city’s dollars in exchange for the greenback remains profitable. This means the long carry trade will continue and more intervention will be needed, according to Mizuho Bank Ltd.

ALSO READ: HKMA says dollar peg, banks remain strong amid protests

Liquidity in the city was tightened by a series of currency interventions in the past two years when lower borrowing costs relative to the US helped drive the currency to the weak end of its trading band. That helped shrink the aggregate balance by 70 percent to HK$54 billion before Tuesday, which was the lowest level since the global financial crisis.

The Hong Kong dollar weakened to as low as 7.7515 on Thursday, before rebounding to trade at 7.7509 as of 4:14 pm.

“Carry trade activities will reduce gradually as Hibor drops,” said Carie Li, an economist at OCBC Wing Hang Bank, adding the HKMA will inject liquidity by selling local dollars and reducing issuance of exchange fund bills.

“Then, another round of Hong Kong dollar strength will be driven by strong capital inflows after the pandemic is over in the medium term.”