People walk past the Ant Group Co mascot displayed at the company's headquarters in Hangzhou, China, Sept 28, 2020. (PHOTO/BLOOMBERG)

People walk past the Ant Group Co mascot displayed at the company's headquarters in Hangzhou, China, Sept 28, 2020. (PHOTO/BLOOMBERG)

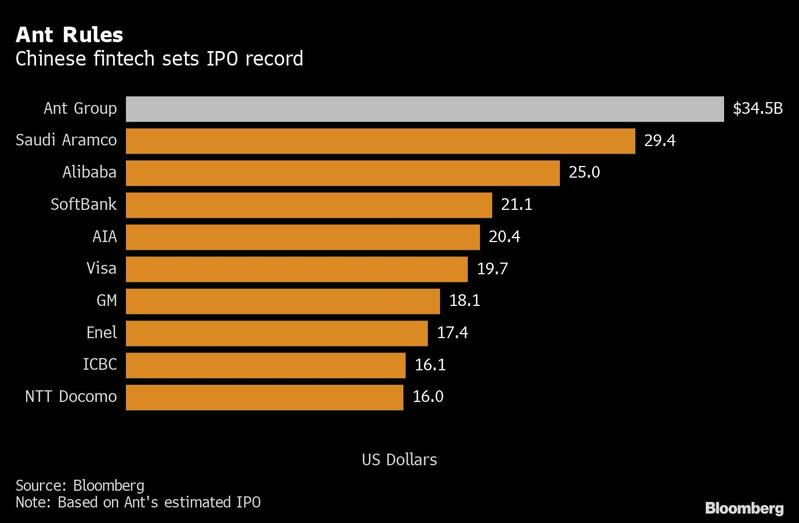

Jack Ma’s Ant Group Co is set to raise about US$34.5 billion through initial public offerings in Shanghai and Hong Kong, a blockbuster listing that will rank as the biggest IPO ever and make it one of the most valuable finance firms on the planet.

Ant priced its Shanghai stock at 68.8 yuan (US$10.27) apiece and its Hong Kong shares at HK$80 (US$10.32) each. The company may raise another US$5.17 billion if it exercises its greenshoe options

The fintech giant will have a market value of US$315 billion even before exercising its greenshoe option, based on filings Monday. That’s about the same valuation as JPMorgan Chase & Co and four times larger than Goldman Sachs Group Inc.

The IPO is attracting interest from some of the world’s biggest money managers, and sparking a frenzy among individual investors on the Chinese mainland clamoring for a piece of the sale. In the preliminary price consultation of its Shanghai IPO, institutional investors subscribed for over 76 billion shares, or over 284 times of the initial offline offering tranche, according to Ant’s Shanghai offering announcement.

“This was the first time such a big listing, the largest in human history, was priced outside New York City,” billionaire founder Ma told the Bund Summit in Shanghai Saturday. “We wouldn’t have dared to think about it five years, or even three years ago.”

READ MORE: Ant Group delivers timely boost to Hong Kong listing market

Such demand puts the much-anticipated IPO on track to surpass Saudi Aramco’s US$29 billion sale last year. Ant priced its Shanghai stock at 68.8 yuan (US$10.27) apiece and its Hong Kong shares at HK$80 (US$10.32) each. The company may raise another US$5.17 billion if it exercises its greenshoe options.

This is “a homecoming for capital markets in Shanghai and Hong Kong,” said existing investor John Ho, founder of Janchor Partners. Ho, who invested US$400 million in Ant two years ago, added that he’s trying to secure a bigger allocation of the Hong Kong shares and that being able to invest in Ant “is priceless.”

“The investment thesis of Ant is a systemic valuation transfer from mainstream Chinese financial institutions such as banks to a platform that’s data-driven, with a huge network effect, and enjoying almost zero marginal costs of cross-selling,” said Nick Xiao, CEO of Hywin International, the Hong Kong arm of Hywin Wealth which is helping rich individuals buy shares of Ant. “Every bank and securities house and fund manager will have to plug into it, while every consumer, corporate or individual, cannot live without it.”

ALSO READ: Ant IPO pushes demand for HK dollar to most on record

The book-building for the Hong Kong leg will run from Monday to Friday, while books of its Shanghai leg will open for one day on Thursday

The fintech giant that runs the Alipay platform is charging ahead with its landmark offering just days ahead of the US election. The Hong Kong listing day will be on Nov 5, only two days after the US vote, an event that could spark market volatility if the vote is disputed or counting delayed.

Ant has picked China International Capital Corp and CSC Financial Co to lead its Shanghai leg of the IPO. CICC, Citigroup Inc, JPMorgan and Morgan Stanley are heading the Hong Kong offering. Existing Ant shareholders won’t be able to sell shares for six months, according to the filings.

The company will issue no more than 1.67 billion shares in Shanghai, equivalent to 5.5 percent of the total outstanding before the greenshoe, according to its prospectus on the Shanghai stock exchange. It will issue the same amount for the Hong Kong offering, or about 3.3 billion shares in total.

The book-building for the Hong Kong leg will run from Monday to Friday, while books of its Shanghai leg will open for one day on Thursday.

Alibaba Group Holding Ltd, which was co-founded by Ma and currently owns about a third of Ant, has agreed to subscribe for 730 million of the Shanghai shares, which will be listed in Shanghai under the ticker “688688,” according to the prospectus. Alibaba will hold about 32 percent of Ant shares after the IPO.

With Reuters inputs