Lipsticks sit on display at a MAC Cosmetics Inc. store in Raffles City shopping mall in Shanghai, China, May 31, 2017. (QILAI SHEN / BLOOMBERG)

Lipsticks sit on display at a MAC Cosmetics Inc. store in Raffles City shopping mall in Shanghai, China, May 31, 2017. (QILAI SHEN / BLOOMBERG)

With consumers staying at home for months and social gatherings banned, the global cosmetics industry has been dealt a major blow by the coronavirus pandemic.

Yet low-cost, online-savvy local beauty brands in China have seen their shares rally as investors spy an opportunity for the home-grown outfits to take market share amid the crisis.

Hangzhou-based Proya Cosmetics Co. has soared 88% this year, surpassing giants like Shiseido Co. and Estee Lauder Cos, while another local make-up brand, Guangdong Marubi Biotechnology Co. has surged 42% this year

Hangzhou-based Proya Cosmetics Co. has soared 88 percent this year, reaching a record high in May and is now trading at 68 times forward earnings, the highest among listed beauty companies worldwide and surpassing giants like Shiseido Co. and Estee Lauder Cos.

Another local make-up brand, Guangdong Marubi Biotechnology Co. has surged 42 percent this year against a 3.9 percent decline in the Shanghai Composite Index and is now trading at 58.7 times forward earnings.

The bull runs come as the local brands’ cheaper products and online-focused sales and marketing platforms seemingly suit a COVID-19 reality in which consumers have less purchasing power and avoid going to public places to shop.

ALSO READ: Masks can't hide eye makeup, the new fashion normal of women

“Domestic brands like Proya have a very fast online growth rate,” said Dai Ming, fund manager with Shanghai-based Hengsheng Asset Management. “International high-end brands hold more market share offline, which makes their business suffer more during the pandemic.”

In the first three months of the year, Shiseido saw a net income decline of 96 percent to 1.4 billion yen (US$12.8 million) while Estee Lauder made a net loss of US$6 million compared to net earnings of US$555 million in the same period a year ago. In contrast, Proya’s net income for the same period fell just 15 percent to 77.7 million yuan (US$11 million), while Guangdong Marubi fell only 1 percent to 118.8 million yuan.

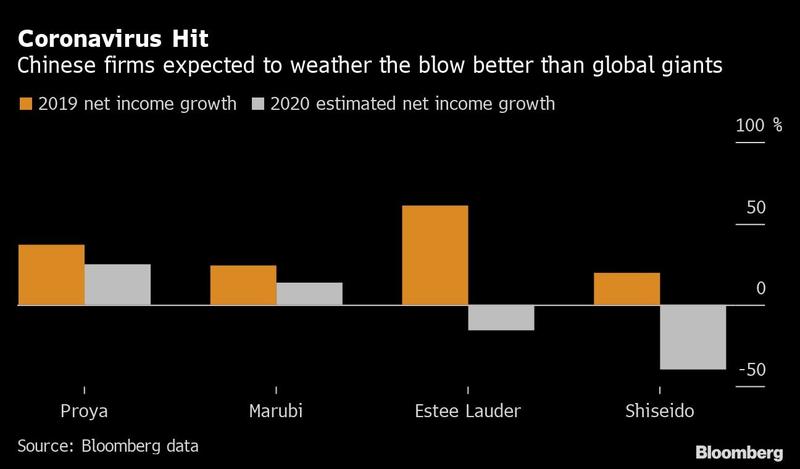

Analysts estimates compiled by Bloomberg show that Proya’s full-year profit is expected to rise 25 percent and Marubi 14 percent, while Shiseido and Estee Lauder are expected to post declines and L’Oreal SA to show a slight gain.

Investor darling

The local Chinese brands have displayed a greater mastery of platforms popular with younger consumers, like livestreaming e-commerce, in which influencers demonstrate and tout items in a broadcast to fans who can purchase them in real time.

The intense, non-stop medium thrives on strategies to boost sales like limited edition items, restricted windows to purchase and celebrity tie-ups.

The industry, already massive in China, is set to grow in a post-pandemic future where more people shop from home given fears of becoming infected in public places. Market size is projected to double this year from US$60 billion last year, according to iiMedia Research.

Proya works with top influencers to push its goods on platforms from Alibaba Group Holding Ltd.’s Taobao and Tmall to Bytedance Inc.’s Tiktok and has an endorsement contract with Chinese singer Cai Xukun, who has 30.4 million followers on Chinese social media platform Weibo.

“I bought Proya’s Elastic Brightening Youth Essence the day I learned of Kun’s endorsement,” said Ian Sun, a 21-year-old university student and fan of the singer. “Then I ordered the second one the next day when Proya launched a special package through Tmall that came with a souvenir of him.” The package included a thermos cup, a necklace and a mirror with the singer’s image.

The local Chinese brands have displayed a greater mastery of platforms popular with younger consumers, like livestreaming e-commerce, in which influencers demonstrate and tout items in a broadcast to fans who can purchase them in real time

READ MORE: Future looking good for men in makeup

Each bottle of essence also only cost 219 yuan, an affordable purchase for Sun compared to items from the other brand Cai endorses - French luxury house Givenchy.

Proya has been shifting its business online even before the pandemic: e-commerce revenue accounted for 53 percent of its business in 2019, up from 44 percent in 2018, according to its annual report.

Long-term prospects

Some analysts say that Proya and Marubi’s gains have been excessive due to investors’ desire for bright spots during the global crisis that’s sickened more than 6.5 million people and killed over 390,000. Both companies are still minnows in market value compared to global beauty brands.

It’s also unclear if their short-term success will translate into long-term share gain in the 478 billion yuan Chinese beauty and personal care market. As of 2019, L’Oreal leads in both skincare and color cosmetics in China, while Proya ranks only 15th and 38th respectively, according to data from Euromonitor International.

And as consumers regain confidence and see incomes grow again after the pandemic passes, the pre-crisis trend of consumers upgrading to premium, higher-quality products sold by foreign brands may return.

Still, as shoppers stay home for now and remain cautious with spending, local beauty brands are trying to seize the moment to woo local consumers who’ve always preferred foreign brands in categories from sports apparel to luxury goods.

“Chinese domestic brands are becoming more acceptable to young consumers,” said Chen Wen, consumer analyst at Wanlian Securities. “The share price reflects the market confidence in a company relatively unaffected by the pandemic and with a consistent performance.”

ALSO READ: Report: China's platform economy reaches US$2.39t