This Oct 9, 2018, file photo shows an oil rig and pump jack in Midland, Texas. (JACOB FORD / ODESSA AMERICAN VIA AP)

This Oct 9, 2018, file photo shows an oil rig and pump jack in Midland, Texas. (JACOB FORD / ODESSA AMERICAN VIA AP)

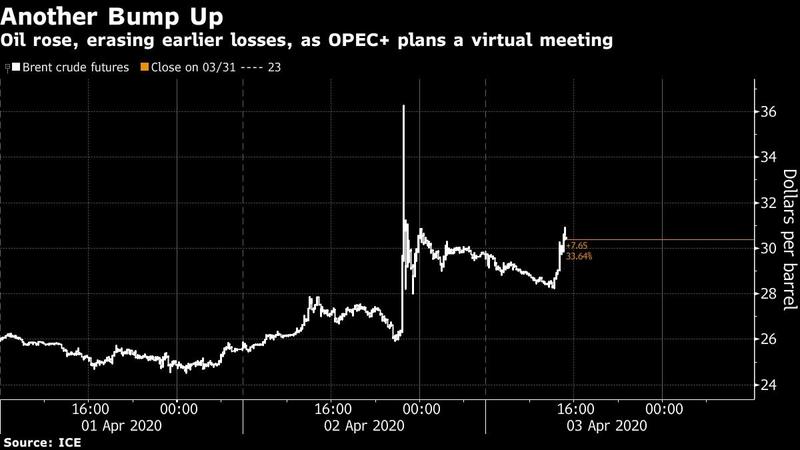

Oil advanced back above US$31 a barrel in London, reversing earlier declines, as OPEC+ scheduled an urgent meeting next week after a historic slump in prices that has crippled the energy sector.

The market is interpreting next week’s meeting as a step closer to some sort of deal that could help address the collapse in prices

The coalition will hold a meeting by video conference on Monday, though it’s still not clear who will attend, according to delegates. News of the plan came just hours after US President Donald Trump said he expected global producers including Saudi Arabia and Russia to cut more than 10 million barrels of production, triggering the biggest ever jump in prices on Thursday.

Futures had been trading lower earlier in the day on Friday on growing doubts over Trump’s claim, with Citigroup Inc. and Goldman Sachs Group Inc. saying any supply deal would anyway be too little, too late as demand craters due to efforts to stem the coronavirus.

But the market is interpreting next week’s meeting as a step closer to some sort of deal that could help address the collapse in prices.

Brent for June settlement climbed US$1.54, or 5.1 percent, to US$31.48 a barrel on the ICE Futures Europe exchange as of 8:43 am in London after falling as much as 5.6 percent earlier. West Texas Intermediate for May delivery rose 0.8 percent to US$25.52 on the New York Mercantile Exchange after declining as much as 7.1 percent earlier.

ALSO READ: Oil, shares slip on doubts over Saudi-Russia deal

The virtual meeting will be open to all producers, not just those that are part of the OPEC+ alliance, according to the delegates. While Trump tweeted Thursday that he had spoken to Saudi Crown Prince Mohammed bin Salman, who had in turn spoken with Russian president, a person familiar with the situation said the US president’s goal is purely aspirational and will ultimately hinge on whether Riyadh and Moscow can reach a deal.

“Even if there is an agreement to curtail 10 million barrels a day of output, the fundamentals show demand destruction and inventory builds,” said John Driscoll, chief strategist for JTD Energy Services Pte in Singapore. The “anxiety and mayhem out there is reminiscent of the financial crisis,” he added.

The outlook for the physical market remains bleak as discounts for some grades of physically delivered oil across the US and Canada widened. Heavy Louisiana Sweet crude lost US$1.75 a barrel relative to West Texas Intermediate to a record US$10.50 discount.

READ MORE: Trump sees Russia-Saudi oil deal soon, says to meet US oil chiefs

Texas Railroad Commission Ryan Sitton, in a rare move for the state’s oil regulator, tweeted on Thursday that he spoke with Russian Energy Minister Alexander Novak and discussed a 10-million barrel a day global output cut and would talk to the Saudi oil minister soon. Trump is scheduled to meet with US oil company executives Friday as the administration seeks ways to help the beleaguered industry.