Coordinated action is needed to survive the consequences of climate change. The UN Global Compact, led by then-UN secretary-general Kofi Annan in 2004, designed the regulatory framework for corporate disclosure, and integrated ESG factors into investment analysis. Today, Hong Kong seeks to position itself as a preferred ESG investment hub, but the COVID-19 economic meltdown may curb climate change resolve, and corporate ESG disclosures do not undo harm to the planet or people. Oswald Chan reports from Hong Kong.

In the 2010s, the compulsive pathology of business growth at any cost came under hostile review. Businesses don’t pay for the “externalities” inflicted on people and the planet. Because they create jobs and pay taxes, “dirty” businesses like coal power, fossil fuels, mining, industrial agriculture, and tobacco, along with toxic processed foods and sugary drinks, are allowed to flourish, as societies absorb their life-threatening damage.

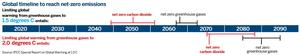

Global warming and climate change were remote concerns, viewed by scientists through the long lens of perhaps another century. Not anymore; we are now behind the curve. Is it too late already? Can we undo the damage? Meanwhile, the economic shocks of COVID-19 may displace climate change priorities, as countries scramble to reboot trade, supply chains, commerce, and jobs.

Reshape investment

In January 2004, then-UN secretary-general Kofi Annan invited 50 major financial institutions to a joint initiative under the UN Global Compact, with the International Finance Corporation and the Swiss government. The goal was to integrate ESG (environmental, social and governance) criteria into asset management, securities brokerage services, and financial research.

![]()

Applying non-financial ESG factors to investment analysis was the major breakthrough to hold corporations to stewardship of the environment, and to encourage practices to protect all stakeholders affected by business activities.

The UN Principles for Responsible Investment charter of April 2006 saw a surge of signatories after the global financial crisis of 2008. Charter membership stands at 2,300 financial institutions, pledging US$80 trillion in assets as of May 2020.

Management consultancies tracking investment returns of ESG-compliant companies confirm their performances are on a par with or higher than those without an ESG focus. That trickled institutional capital away from non-ESG-compliant companies, thus making ESG the new ethos for pension and retirement funds.

On the bandwagon

Responding to that trend, credit rating agencies, index compilers, financial information providers, and other intermediaries scrambled to jump on the ESG bandwagon. An ecosystem of ESG investors evolved. But like the proverbial six blind men who all perceive an elephant in a different way, the players cannot agree on what it is, but monetize the confusion anyway. As a result, there is no global ESG standard, and ESG ratings float untethered to outcomes.

The “social” and “governance” (S&G) effects of ESG are puny within the climate and disease disasters assailing humanity. S&G effects are easily fixed, unlike the E-factor — the ratio of mass of waste from a product to the mass of a product — which wrecks future generations and risks our sustainability. Rating agencies diminish E-factor weighting, granting ESG passes to profiteers in mining, oil, coal, cigarettes, deforestation, industrial agriculture, chemicals, processed foods, sugary drinks, etc., which, by definition, should fail.

Moody’s, Fitch and MSCI are leading credit-rating agencies offering ESG scores that are neither comparable, compatible, nor sufficient in preventing harm to humans or the environment. But that does not distress the regulators, rating agencies, or the regulated. All are pleased to display ESG badges to traffic investment — which is the primary business of the players.

Sobering SFC poll

A Securities and Futures Commission survey of 794 Hong Kong asset management companies in 2019 found 83 percent would consider ESG disclosure. Of those who would consider it, 65 percent had no oversight measures in place, while 35 percent did have a consistent approach. About 68 percent of those needing ESG disclosure could not produce any process documentation.

The Financial Services Development Council, the government’s high-level, cross-sector advisory platform to promote the city’s financial services industry, said a road map for ESG integration is needed. The ultimate objective is to develop Hong Kong into a preferred sustainable finance and investment hub.

Board members, who are required to sign off company ESG disclosures, may not be familiar with the subject. Pat Woo, KPMG China Partner and Hong Kong head of sustainable finance, believes it is vital for boards to understand the ESG compliance link to improved business performance.

“ESG is not just about annual reports. Boards need to understand how ESG integration can enhance business and financial performance,” said Mary Leung, Asia Pacific head of advocacy for the CFA Institute. Costs will accrue for compliance and training, and to engage ESG specialists for data gathering and documentation.

Hong Kong Institute of Chartered Secretaries President Gillian Meller said, “Hong Kong should track global developments on ESG reporting and standardization, which many stakeholders are calling for.”

BlackRock hoists ESG

Larry Fink, CEO of BlackRock, the world’s largest private asset manager with US$6.5 trillion under management, jolted financial markets in January when he flagged ESG criteria as a BlackRock priority when it reviews portfolio companies over the next five years. Fink plans to double BlackRock’s global ESG exchange-traded funds to 150.

"Companies, investors, and governments must prepare for a significant reallocation of capital. If 10 or 5 percent of funds do so, we will witness massive capital shifts."

Larry Fink, chairman and CEO, BlackRock

Barron’s reported that BlackRock will anchor climate-risk analysis in its evaluation process, forcing its portfolio companies to report sustainability metrics. Managements that stall will be voted down. CEOs will fall in line. Nothing energizes CEOs faster than stock price risk; their compensation depends on that.

But was it just great marketing, or genuine commitment to shut down damage to the environment? Jeremy Grantham, co-founder of Grantham, Mayo and van Otterloo, asks why BlackRock does not exit thermal-coal in its index funds, and get out of fossil fuels altogether. “After all, oil is the mother and father of all vested interests,” said Grantham, who has pledged 98 percent of his US$1 billion in personal wealth to combat climate change through grants and endowments to university institutions.

Leslie Samuelrich of Green Century Capital Management (GCCM), which offers fossil-fuel-free funds, said that BlackRock is still the largest investor in fossil fuels, and wonders how serious it can be about climate change. GCCM is the only US mutual fund wholly owned by public health and environmental nonprofit entities. Samuelrich, also a board member of US-SIF, the trade alliance on sustainable investing, said BlackRock cannot have it both ways.

But critics say Fink is having it both ways. The investment returns on hydrocarbons remain positive even as the dirty industry waddles to clean energy over another half-century. Fink asserts ESG disclosures will pressure fossil-fuel companies to shift to cleaner coal processes, and to renewable energy. So BlackRock herds the offending companies to transition while pocketing profits en route.

‘Do no harm’

One month after Fink’s announcement, Chamath Palihapitiya, chairman of Virgin Galactic and a regular guest on US business-news cable network CNBC, ruffled Wall Street in February when he dismissed ESG as a “complete fraud … with plenty of sizzle but no steak.” Palihapitiya said the ESG paper shuffle is nothing more than self-serving finance industry tokenism, which fails to address the real problems. They game the system, he said, adding that funds “paint green” to qualify for the European Central Bank’s negative-interest loans.

“ESG is a complete fraud ... a joke. Any serious company can just stop doing harm. By painting ‘green’ in Europe, funds can borrow money from the European Central Bank at negative rates.”

Chamath Palihapitiya, chairman, Virgin Galactic

Palihapitiya, a billionaire and an early senior executive at Facebook, calls out the fakery of ESG. Environmental degradation, global warming, and climate change are real issues that require practical solutions. “It is simple: Do no harm,” he said. Business activity that pollutes the earth, air and water, and products that harm consumers are obvious targets to shut down — but that is not happening at all, he said.

Instead, the very companies that foul the atmosphere, degrade nature, and poison humans are “greenwashed” by ESG rating agencies to attract more investment to carry on, regardless. The failure of ESG disclosures to cut off funding to dirty businesses is the credibility gap Palihapitiya rails against.

McKibben’s 350.org

Bill McKibben, environmentalist, author, and educationist, wrote the first non-academic book for ordinary folk about global warming and its consequences for humanity. The End of Nature, published in 1989, was the climate change bible for a generation of youth concerned about the appalling disasters awaiting them. McKibben formed 350.org in 2008 as a global grassroots network of academics, researchers, social activists, and community organizers, to support renewable energy, and oppose coal plants, fossil-fuel projects, and mega pipeline infrastructure. It established the International Day of Climate Action in 2009.

To cut off funding to fossil fuel companies, 350.org lobbied more than 1,000 universities, churches, foundations, and municipalities to withdraw more than US$12 trillion in investment. Among 350.org’s more notable engagements were the Keystone XL Dakota Access Pipeline, and the halting of fracking across hundreds of cities in Argentina and Brazil.

It allies with grassroots activists like the People’s Climate March and Global Climate Strike. It is a bottom-up energization of communities that suffer the consequences of corporate malfeasance and government neglect.

Contact the writer at oswald@chinadailyhk.com