A screen displays stock figures outside the Exchange Square complex, which houses the Hong Kong stock exchange, in Hong Kong, on Sept 16, 2019. (PAUL YEUNG / BLOOMBERG)

A screen displays stock figures outside the Exchange Square complex, which houses the Hong Kong stock exchange, in Hong Kong, on Sept 16, 2019. (PAUL YEUNG / BLOOMBERG)

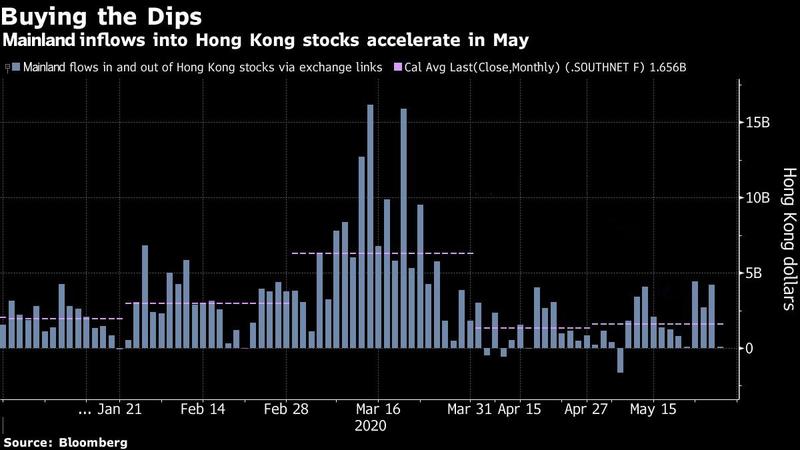

Mainland money is flowing into Hong Kong’s stocks at an unparalleled pace, offering support to the special administrative region's market.

Eligible investors, which can range from brokers to insurers or individuals with at least 500,000 yuan (US$70,000) in their trading accounts, had been net buyers of Hong Kong stocks in all but six sessions this year and pumped US$35.4 billion so far across the border, the most for the period in data going back to 2017. The top targets of inflows were Chinese state-owned firms.

READ MORE: HK next up in world's growing list of stock bear markets

History shows mainland buying tends to pick up when Hong Kong shares drop. Onshore investors bought the dip in March when the Hang Seng Index fell to its lowest in more than three years. State-backed funds have also stood by to help steady Hong Kong’s markets around key political events, such as in 2017 when President Xi Jinping visited the city to mark 20 years of its return to the motherland.

Hong Kong equities extended losses Wednesday afternoon, with the Hang Seng falling as much as 1.1 percent before closing down 0.4 percent. The city’s chief executive, Carrie Lam Cheng Yuet-ngor, had said Tuesday that the national security law can bolster business confidence, citing the Hang Seng’s rebound that day. She added that concerns over the law were unwarranted.

Mainland investors now own about 2.9 percent of the total market value of Hong Kong stocks eligible for cross-border trading, the highest since Hong Kong exchange data became available in March 2017, according to Bloomberg calculations

Mainland investors now own about 2.9 percent of the total market value of Hong Kong stocks eligible for cross-border trading, the highest since Hong Kong exchange data became available in March 2017, according to Bloomberg calculations. Mainland buyers’ top three targets since Friday’s slide have been Industrial & Commercial Bank of China Ltd., Ping An Healthcare and Technology Co. and China Construction Bank Corp., according to data compiled by Bloomberg.

Some onshore money managers say they are taking note of a widening valuation gap with yuan-denominated shares, mainly focusing on large financial companies.

“As long as we stick with Hong Kong-listed companies with businesses on the mainland, the risks are completely manageable,” said Du Kejun, a partner at Beijing Gelei Asset Management Center LP.

The MSCI Hong Kong Index, which unlike the Hang Seng Index doesn’t include mainland firms, has fallen 21 percent in the past 12 months, led by real estate firms.

ALSO READ: HK may become a magnet for US-listed mainland companies

One of the main attractions of Hong Kong stocks for mainland investors is low valuations. The Hang Seng China Enterprises Index of Chinese firms listed in the city trades at eight times the next 12 months’ projected earnings, compared to 11 times for the Shanghai Composite Index.

Chen Jiahe, chief investment officer of the family office firm Novem Arcae Technologies Co., said he wanted to buy more Hong Kong-listed Chinese mainland stocks last week but ran short of funds.

“We actually had to sell some of our A-share holdings to buy Hong Kong stocks,” he said. “And we’ll buy more if the market declines further and reinvest all dividends.”